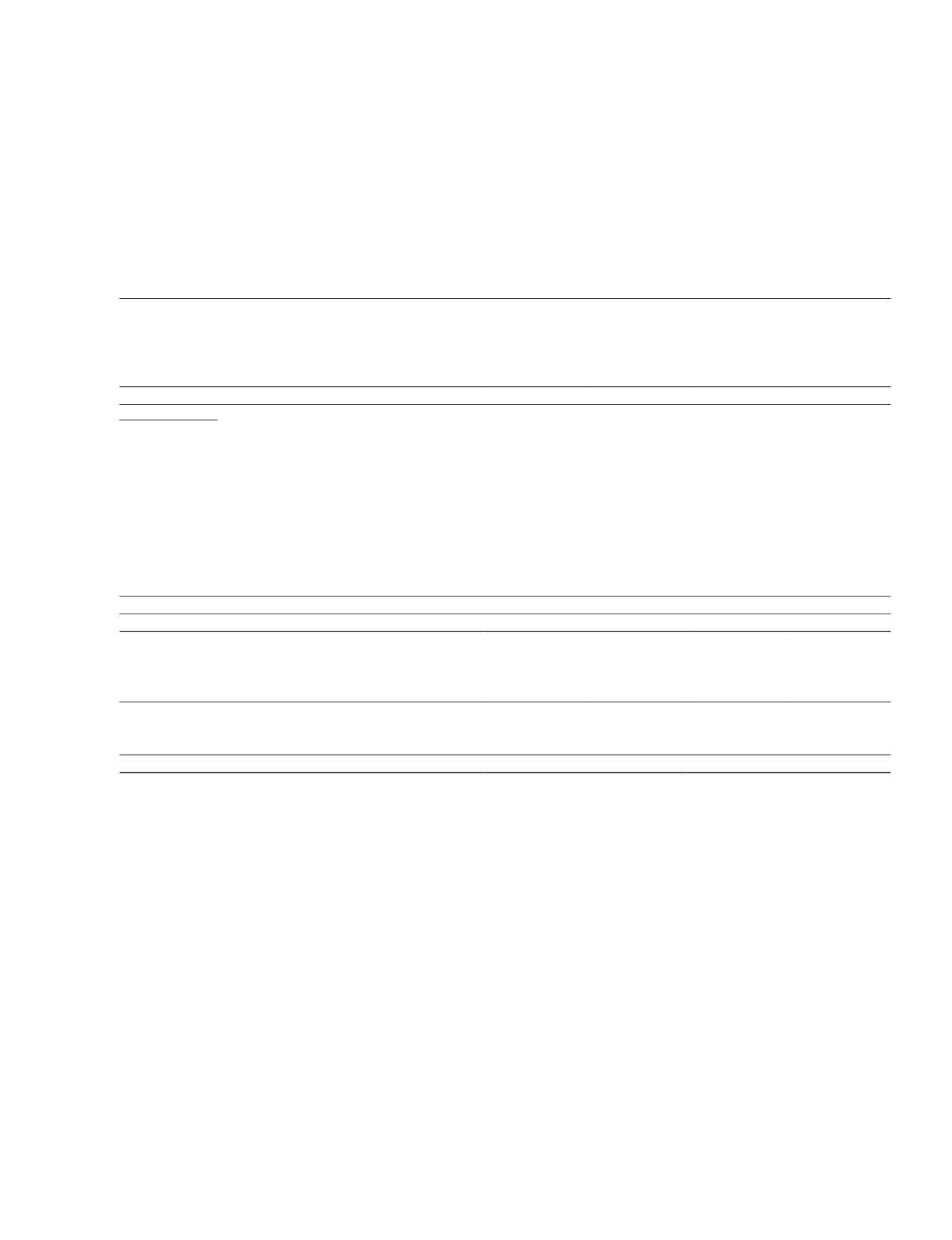

NOTES TO THE FINANCIAL STATEMENTS

For the Financial Year Ended 31 December 2014

34 TRADE AND OTHER PAYABLES

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Current:

Trade payables

9,311

15,975

56

2,735

Advance receipts and billings

360

248

14

12

Amounts due to associates

9

–

3

–

9,680

16,223

73

2,747

Other payables

Amounts due to subsidiaries

–

–

528,306

236,282

Amounts due to a non-controlling shareholder of a

subsidiary

21,403

–

–

–

Accrual for development cost

152

1,899

–

–

Accrual for other charges

7,869

11,355

1,820

1,669

Other deposits

2,514

2,784

370

313

Severance benefit obligations

–

21

–

–

Amounts due to associates

5,349

1,315

832

–

Amounts due to joint ventures

14,684

17,244

–

–

Others

15,829

17,129

3,109

3,077

67,800

51,747

534,437

241,341

Trade and other payables

77,480

67,970

534,510

244,088

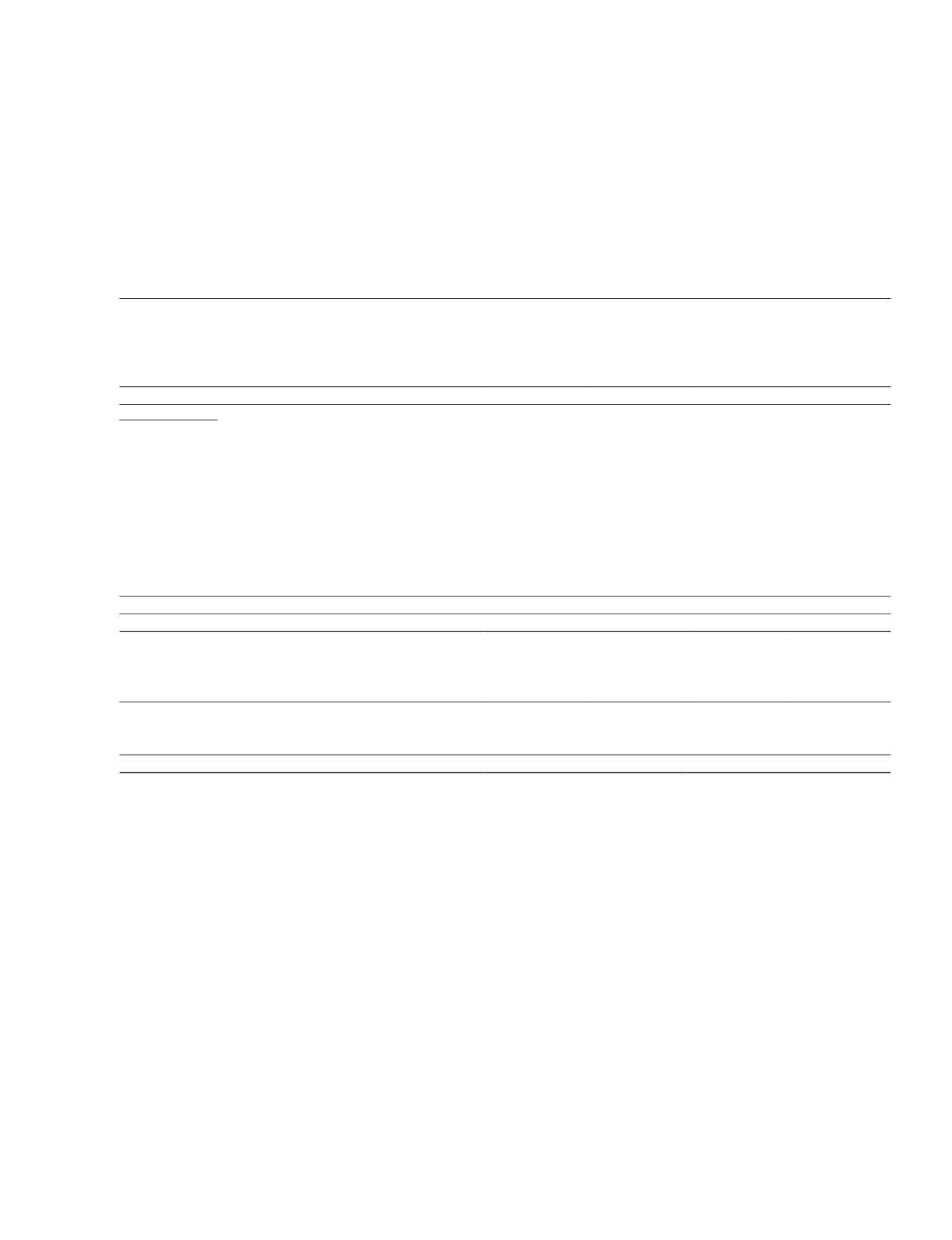

Trade and other payables

77,480

67,970

534,510

244,088

Less: Advance receipts and billings

(360)

(248)

(14)

(12)

Severance benefit obligations

–

(21)

–

–

77,120

67,701

534,496

244,076

Add: Other non-current liabilities (note 33)

64

374

–

–

Loans and borrowings (note 32)

466,272

429,964

–

224,357

Total financial liabilities carried at amortised cost

543,456

498,039

534,496

468,433

Trade payables

The Group’s normal trade credit ranges from cash payment to 90-day terms.

Amounts due to subsidiaries

The amounts payable to subsidiaries are non-trade related, unsecured, non-interest bearing and repayable on demand.

Amounts due to a non-controlling shareholder of a subsidiary

The amounts due to a non-controlling shareholder of a subsidiary are related to its share of funding to the Group’s 89.5%

owned subsidiary, Straits Real Estate Pte. Ltd.. The amounts are unsecured, bear interest at 2.8% per annum and repayable

on demand.

Amounts due to associates

The amounts payable to associates are non-trade related, non-interest bearing and repayable on demand.

135

THE STRAITS TRADING COMPANY LIMITED ANNUAL REPORT 2014