NOTES TO THE FINANCIAL STATEMENTS

For the Financial Year Ended 31 December 2014

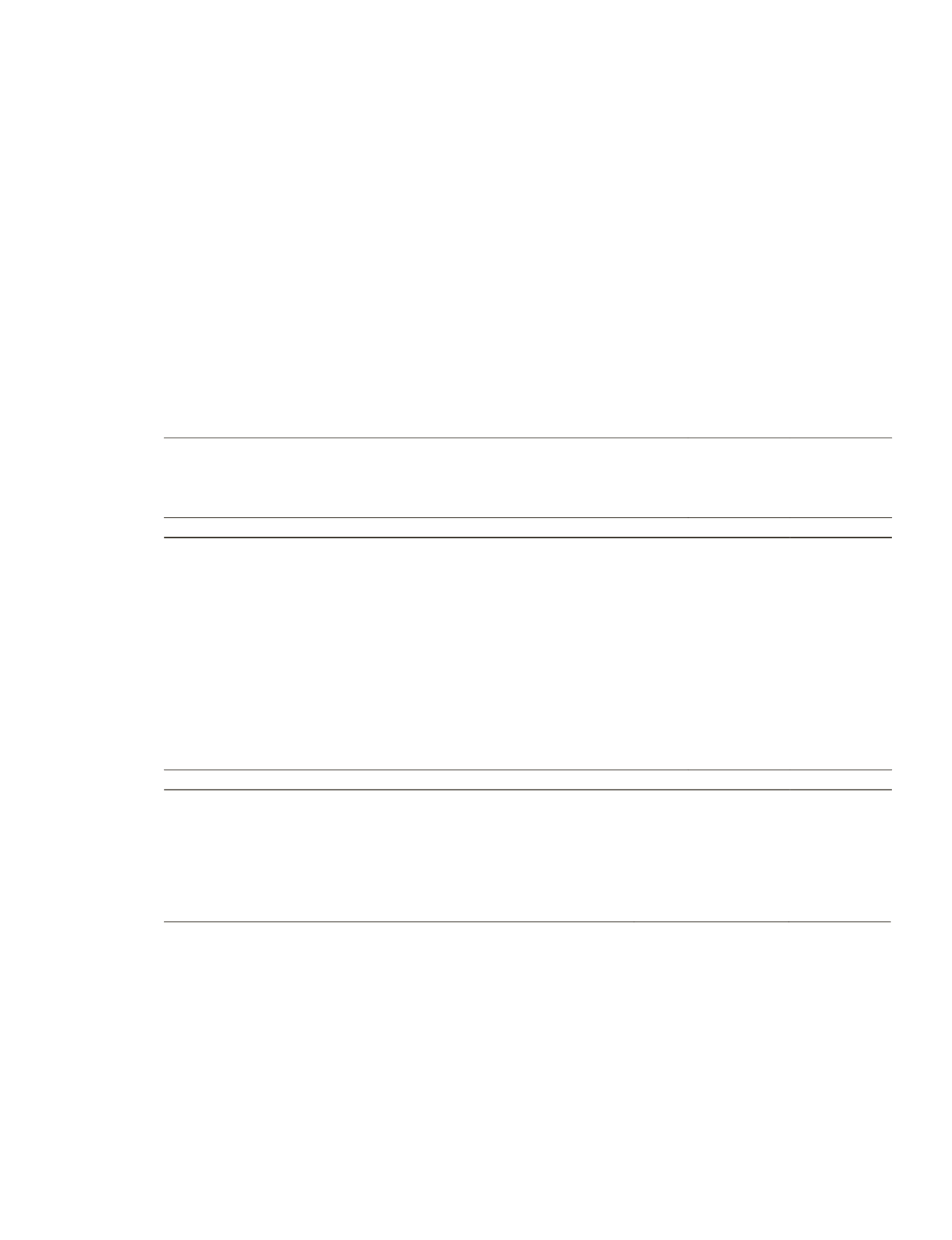

12 INCOME TAX EXPENSE (CONT’D)

(b)

Relationship between tax expense and accounting profit/(loss)

The reconciliation between tax expense and the product of accounting profit/(loss) multiplied by the applicable

statutory tax rate for the years ended 31 December 2014 and 2013 are as follows:

Group

2014

2013

(restated)

$’000

$’000

Profit before tax from continuing operations

33,082

108,466

Loss before tax from discontinued operations (note 24)

(7,704)

(15,169)

Less: Share of results of equity-accounted associates and joint ventures *

(14,866)

16,835

10,512

110,132

Tax at statutory rate of 17% (2013: 17%)

1,787

18,722

Effect of different tax rates in other countries

633

85

Under/(Over) provision in respect of prior years

351

(14,309)

Under/(Over) provision of deferred tax in respect of prior years

36

(37,360)

Expenses/Losses not claimable

14,409

30,334

Income not subject to tax

(7,545)

(26,825)

Effect of partial tax exemption

(354)

(328)

Deferred tax asset not recognised

–

1,060

Utilisation of previously unrecognised tax losses and unutilised capital

allowances

(194)

(3,068)

Others

61

(1,618)

9,184

(33,307)

* These are presented net of tax in profit or loss.

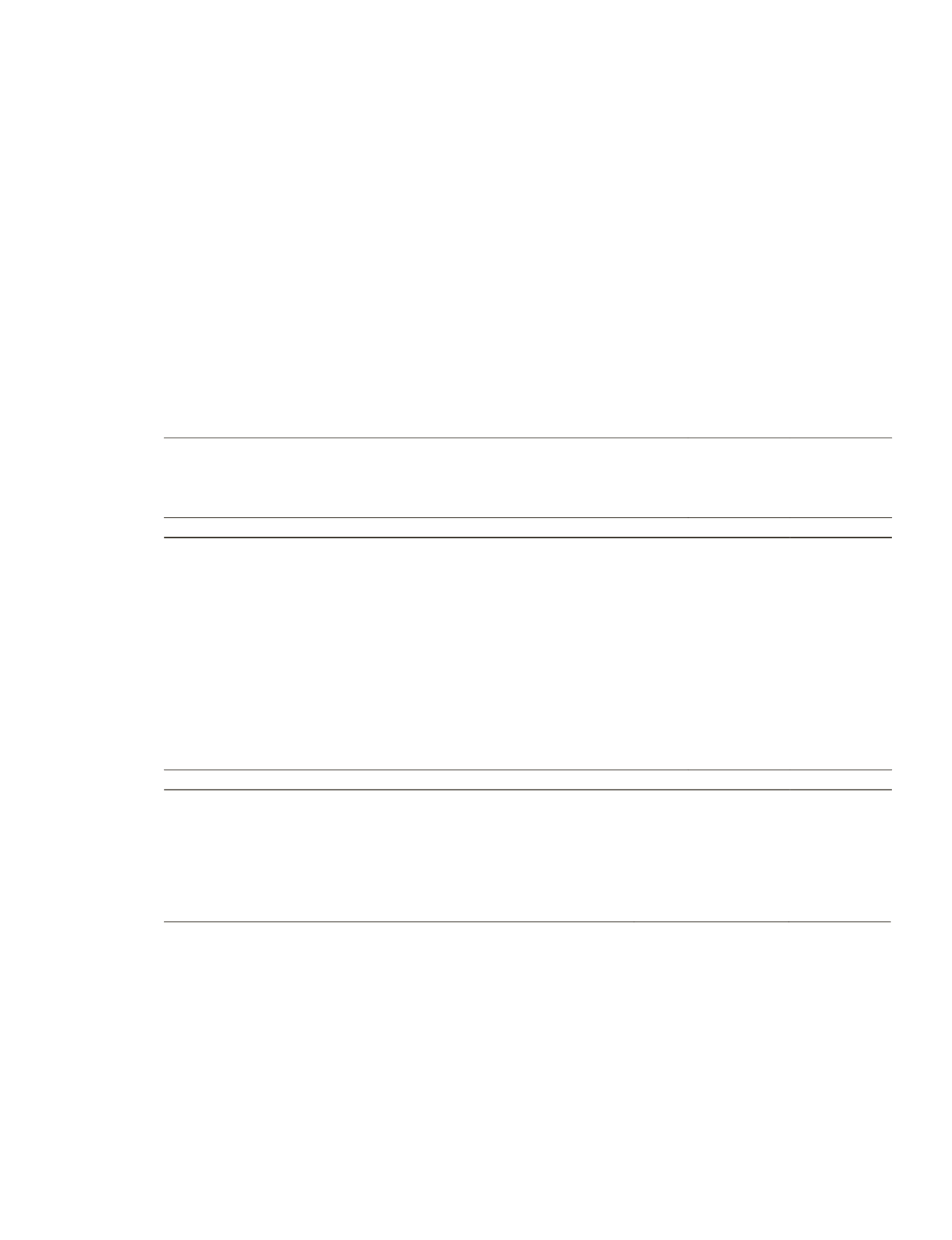

Taxation for other jurisdictions are calculated at the rates prevailing in the respective jurisdictions. During the current

financial year, the income tax rate applicable to foreign subsidiaries are as follows:

2014

2013

Malaysia

25%

25%

Indonesia

25%

25% and 30%

Australia

30%

30%

89

THE STRAITS TRADING COMPANY LIMITED ANNUAL REPORT 2014