NOTES TO THE FINANCIAL STATEMENTS

For the Financial Year Ended 31 December 2014

43 FAIR VALUE OF ASSETS AND LIABILITIES (CONT’D)

D.

Level 3 fair value measurements (cont’d)

ii)

Movements in Level 3 assets and liabilities measured at fair value (cont’d)

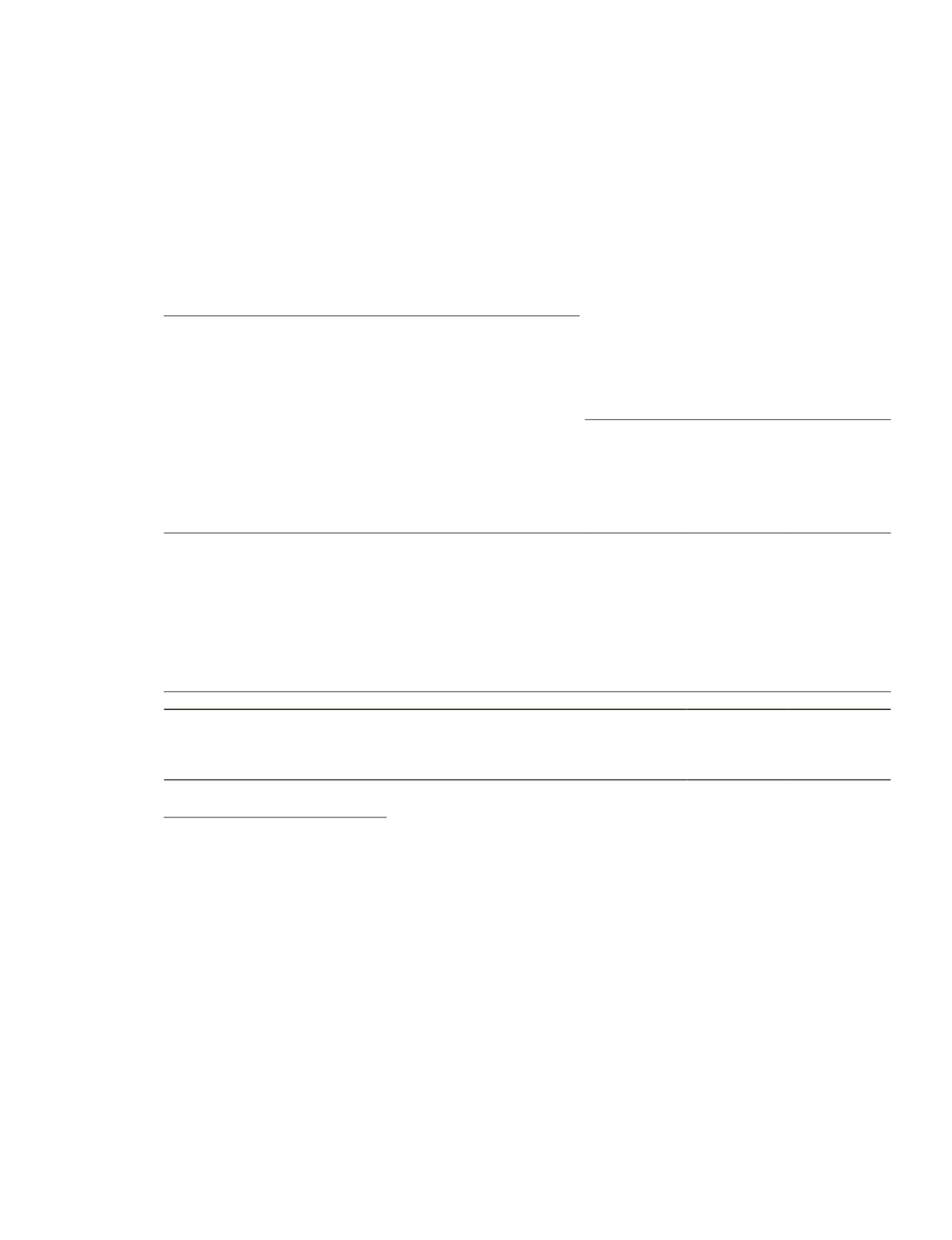

Group

2013

$’000

Fair value measurement using significant

unobservable inputs (Level 3)

Available-for-

sale financial

assets

Property,

plant and

equipment

Unquoted

equity

securities

Land and

buildings

Total

At 1 January

3,646

16,352

19,998

Total gains or losses for the period

included in other comprehensive income

–

697

697

Transfer in

–

355

355

Depreciation

–

(306)

(306)

Additions

–

24

24

Impairment

(3,543)

–

(3,543)

Exchange adjustment

(103)

(536)

(639)

At 31 December

–

16,586

16,586

Total gains or losses for the period included in

Other comprehensive income:

– Net surplus on revaluation of land and buildings

–

697

697

iii)

Valuation policies and procedures

It is the Group’s policy to engage external valuation experts to perform the valuation. The management is responsible

for selecting and engaging valuation experts that possess the relevant credentials and knowledge on the subject

of valuation, valuation methodologies, and FRS 113 fair value measurement guidance.

The Group revalues its properties and the valuation techniques used are as follows:

a)

Market comparable approach that considers the sales of similar properties that have been transacted in

the open market with adjustment made for differences in factors that affect value.

b)

Depreciated replacement cost method that is based on an estimate of the current market value of the land,

plus the current gross replacement of improvements, less allowances for physical deterioration, obsolescence

and optimisation.

161

THE STRAITS TRADING COMPANY LIMITED ANNUAL REPORT 2014