NOTES TO THE FINANCIAL STATEMENTS

For the Financial Year Ended 31 December 2014

42 SIGNIFICANT ACCOUNTING ESTIMATES AND JUDGEMENTS (CONT’D)

(a)

Estimation Uncertainty (cont’d)

(iii)

Amortisation and impairment of deferred mine exploration and evaluation expenditure, deferred mine

development expenditure and mining rights

These require estimates and assumptions on the quantity of economically recoverable ore reserves and

resources, expected future costs and expenses to produce the metal or minerals, effective interest rates,

expected future prices used in the impairment test for deferred mine exploration and evaluation expenditure,

deferred mine development expenditure and mining rights. The estimate of the quantity of economically

recoverable ore reserves and resources are also used for the amortisation of deferred mine exploration and

evaluation expenditure, deferred mine development expenditure and mining rights. Actual outcomes could

differ from these estimates and assumptions.

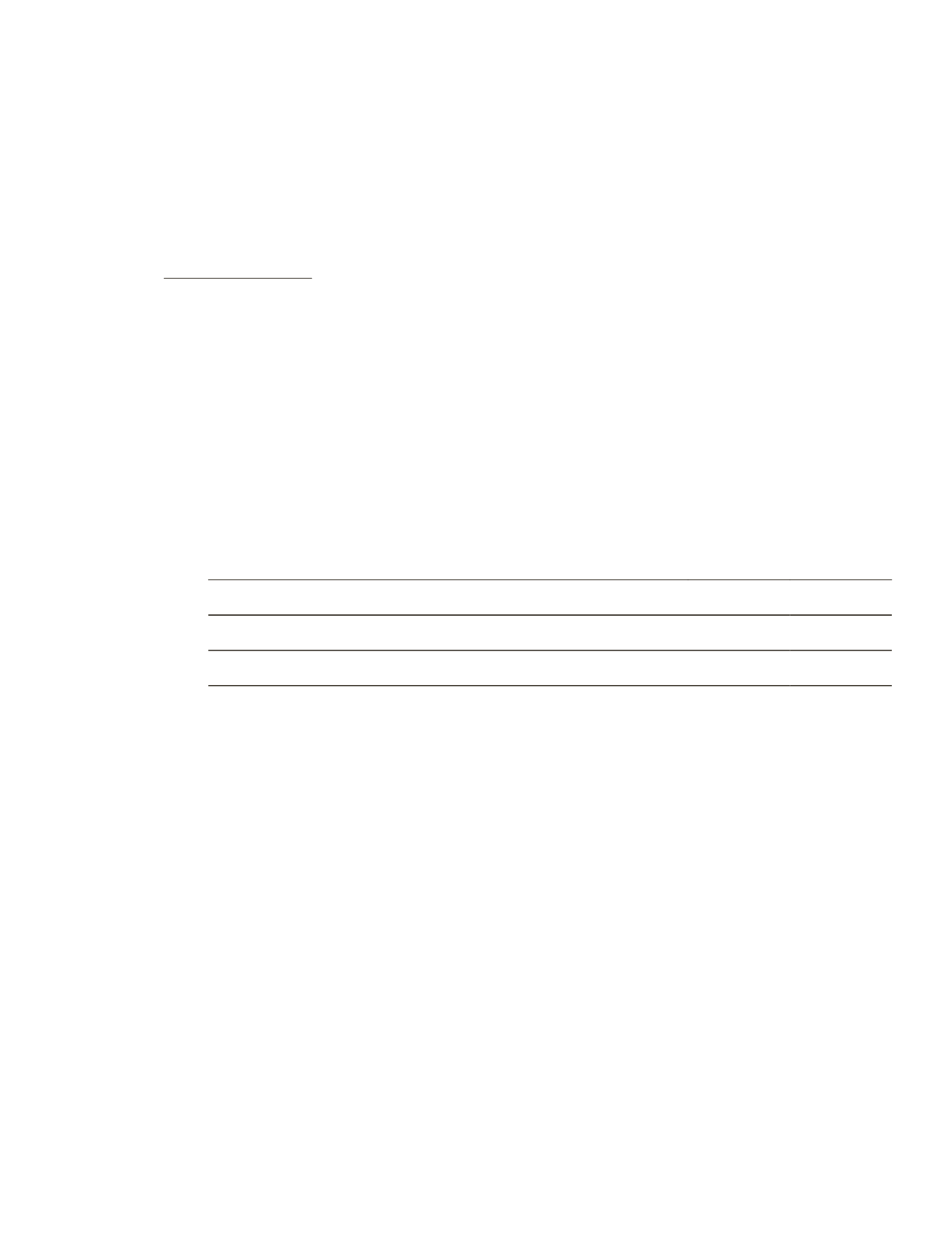

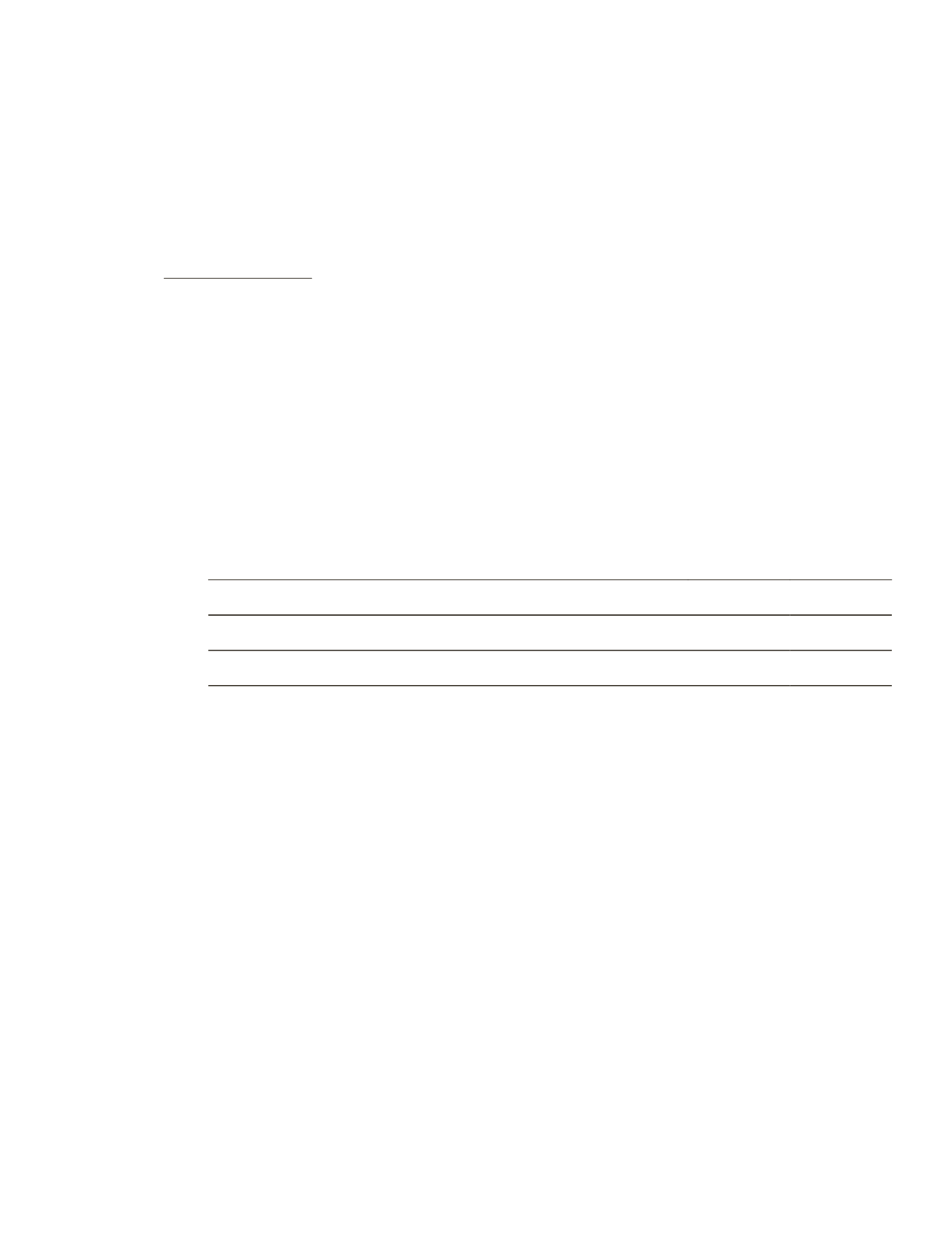

The carrying amounts are as follows:

Group

2014

2013

$’000

$’000

Deferred mine exploration and evaluation expenditure

3,068

1,830

Deferred mine development expenditure

1,267

947

Mining rights

3,058

2,903

(iv)

Revaluation of properties

The Group carries its properties at fair value. Changes in fair values of investment properties are recognised

in profit or loss and changes in fair values of the other properties are recognised in other comprehensive

income respectively.

The fair values of properties are determined by independent real estate valuation experts using recognised

valuation techniques. These techniques comprise comparison method, investment method or depreciated

replacement cost method.

The determination of the fair values of the properties require the use of estimates such as:

– sales of similar properties that have been transacted in the open market with adjustment made for

differences in factors that affect value,

– the net rent of the properties is capitalised at a suitable rate of return. The net rent is the balance sum

after deducting service charge, property tax and a reasonable percentage for vacancy from the gross

rent. The value of the property is arrived at by capitalising this net rent at a suitable rate of return, and

– an estimate of the current market value of the land, plus the current gross replacement of improvements,

less allowances for physical deterioration, obsolescence and optimisation.

153

THE STRAITS TRADING COMPANY LIMITED ANNUAL REPORT 2014