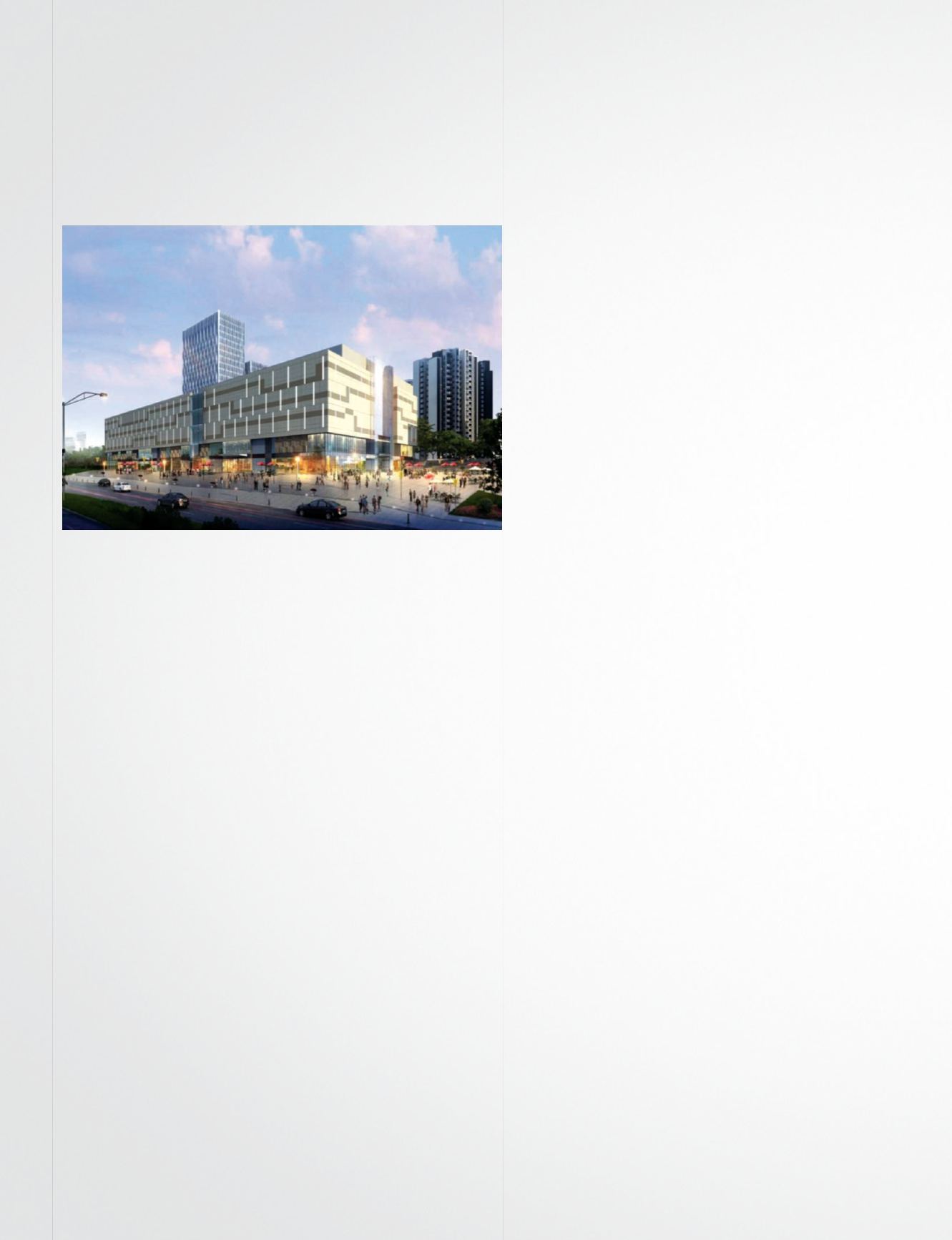

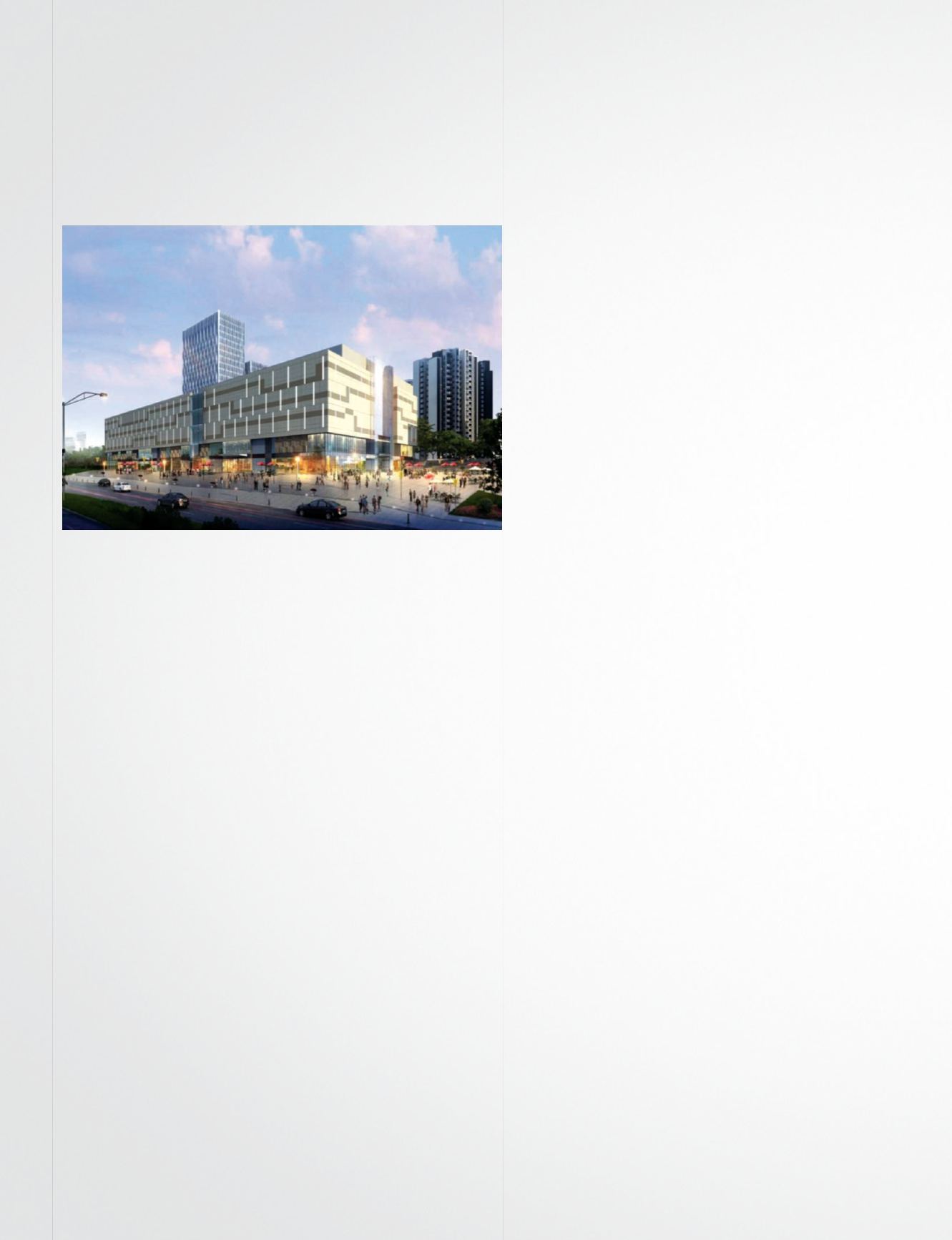

Artists impression of SRE’s retail project in Chongqing, China

YEAR IN REVIEW

Real Estate (continued)

Maiden Investment Project in China

Straits Real Estate has committed to acquiring a retail mall

in Chongqing, China. Located in Chayuan, a new middle-

income district, the mall will be the first organised retail

scheme in the area. When completed, the mall will have

a total gross floor area of approximately 82,367 square

metres, distributed over two basements and five above-

ground levels. The property is part of a larger mixed-use

development that comprises 29 residential buildings, 4

office towers, a hotel and an open-air street mall. The mall

is also directly linked to the subway station through the

basement floor, and enjoys excellent access to other parts of

Chongqing via a well developed network of ring roads and

expressways.

ARA Summit Development Fund 1 L.P. (“SDF 1”)

During the year, Straits Real Estate also committed to

investing in SDF 1, managed by ARA Asset Management

Limited. SDF 1 is a private real estate investment fund with

a mandate to invest in green or brown field development

projects in Australia and South East Asia.

For more information on Straits Real Estate Pte. Ltd., please

visit

SRE Capital Pte. Ltd. (“SRE Capital”)

Straits Real Estate has also set up SRE Capital. SRE Capital’s

core business is in the management of both internal and

third-party capital for investment in publicly listed REITs,

asset-backed trusts and corporate securities in the real estate

and infrastructure sectors within the Asia Pacific region.

For more information on SRE Capital Pte. Ltd., please visit

ARA ASSET MANAGEMENT LIMITED (“ARA”)

ARA, a 20.1% owned associate company of Straits Trading,

is one of the largest real estate fund managers in the region

that manages listed REITs in Singapore, Hong Kong and

Malaysia with diversified portfolio across the office, retail

and industrial sector. ARA also invests and manages

private real estate funds in Asia and provides real estate

management services.

In 2014, ARA delivered another year of outstanding

performance, with 23% and 18% year-on-year growth in

revenue and net profit respectively. Total assets under

management (“AUM”) grew 1.7% year-on-year from S$25.9

billion to S$26.3 billion despite ongoing divestments by its

private funds.

During the year, apart from organic growth driven by its

existing REITs and private fund platforms, ARA continued

to seek out exciting growth opportunities by penetrating

new markets. One such example is the completion of the

acquisition of Macquarie Real Estate Korea Limited in April

26

THE STRAITS TRADING COMPANY LIMITED ANNUAL REPORT 2014