Profit before tax at RM29.8 million in FY2014 was 13% lower

than that in FY2013, mainly attributable to higher mining

costs. In March 2014, RHT acquired an 80% interest in SL Tin

Sdn Bhd (“SL Tin”) a company which had secured a mining

lease of 267 hectares with prospective tin mineralisation

located near Sungei Lembing Town, Hulu Kuantan, in the

state of Pahang for a period of 15 years.

DISPOSAL OF INDONESIAN OPERATIONS AND

OTHER NON-TIN ASSETS

Following the divestment of Bemban Corporation Limited,

the holding company of PT Koba Tin, as well as PT MSC

Indonesia in June 2014, MSC has ceased all operations in

Indonesia. The de-consolidation of the assets and liabilities

after the disposals of its Indonesian subsidiaries has resulted

in some non-cash adjustments which have been classified

under discontinued operations. During the financial year

ended 31 December 2014, the Group carried out a review of

the recoverable amount of its investment in KM Resources

Inc (“KMR”) and recognised an impairment provision of

RM4.2 million. Currently, KMR is in the process of being

wound up.

ITRI TIN SUPPLY CHAIN INITIATIVE (ITSCI)

Significant efforts were expended by MSC during the year to

promote and expand the implementation of the iTSCi due

diligence scheme for the responsible sourcing of metals and

minerals in the Central African countries, at the upstream

end of its supply chain. The iTSCi scheme is backed by all

stakeholders and has been very successful in its agenda to

ensure traceability of tin and tantalum minerals, sourced

from the Democratic Republic of Congo (“DRC”) and

adjoining countries, to ensure that minerals sourced by

the tin smelting industry from Central African countries are

conflict free.

MSC continues to actively engage with all stakeholders

of the global tin industry to promote the concept of

sustainability in its business.

OUTLOOK

As the global commodity industry continued to

remain depressed in the current down cycle, the market

environment for tin will continue to be challenging.

Although the supply side in the global tin industry remains

a thorny and unpredictable issue as artisanal production

operations still constitute a high proportion of world tin

production, MSC will continue to focus on sustainable

improvements in its core operations. This is underpinned by

MSC’s efforts in 2014 to expand capacity at the Butterworth

smelting facility as well as in RHT where a comprehensive

exploration programme is on-going and designed to expand

its tin resource base.

MSC has been through many economic and commodity

cycles and this is a strong testament to its operational ability

to withstand the down cycle and position itself to reap the

benefit from the upswing.

For more information on Malaysia Smelting Corporation

Berhad, please visit

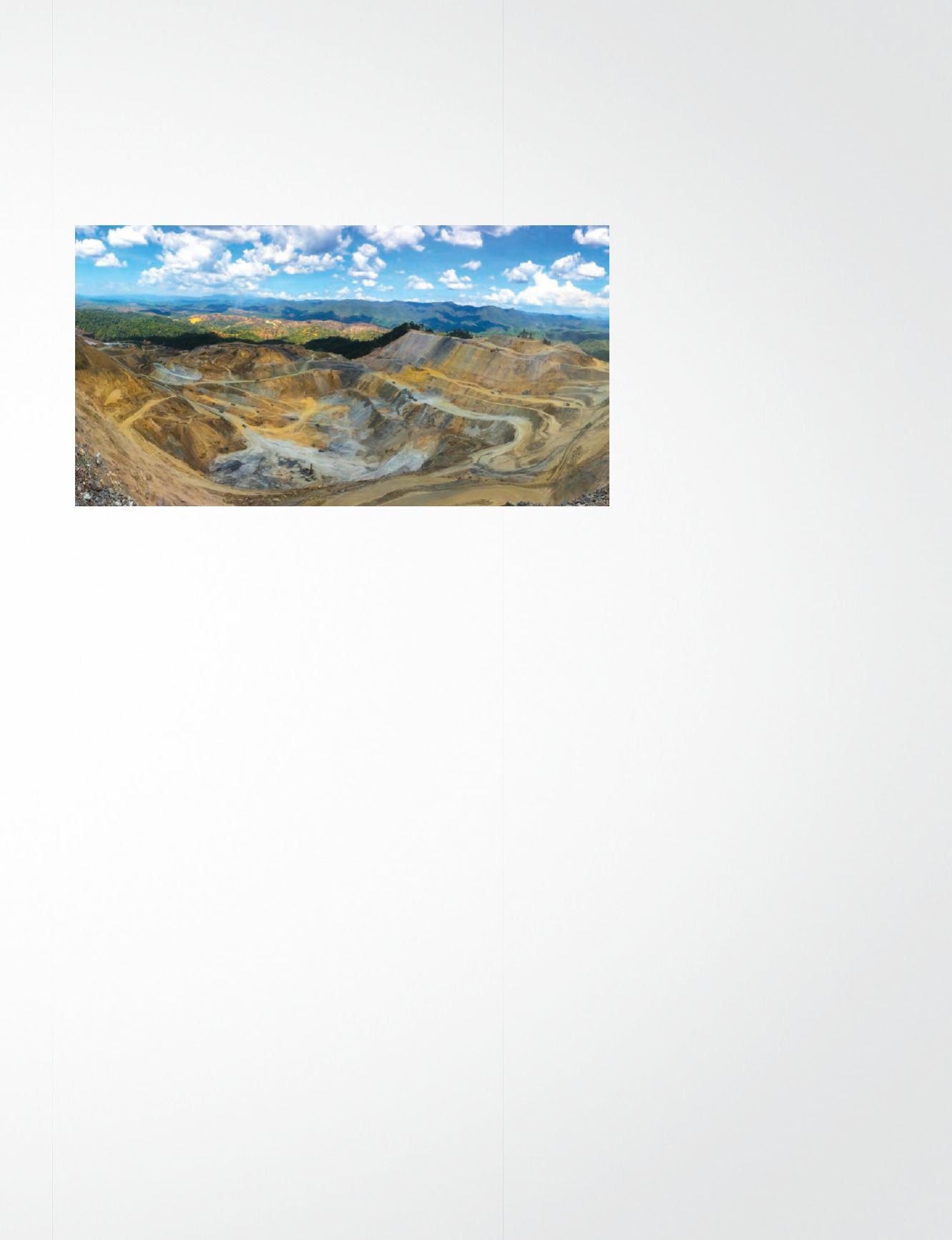

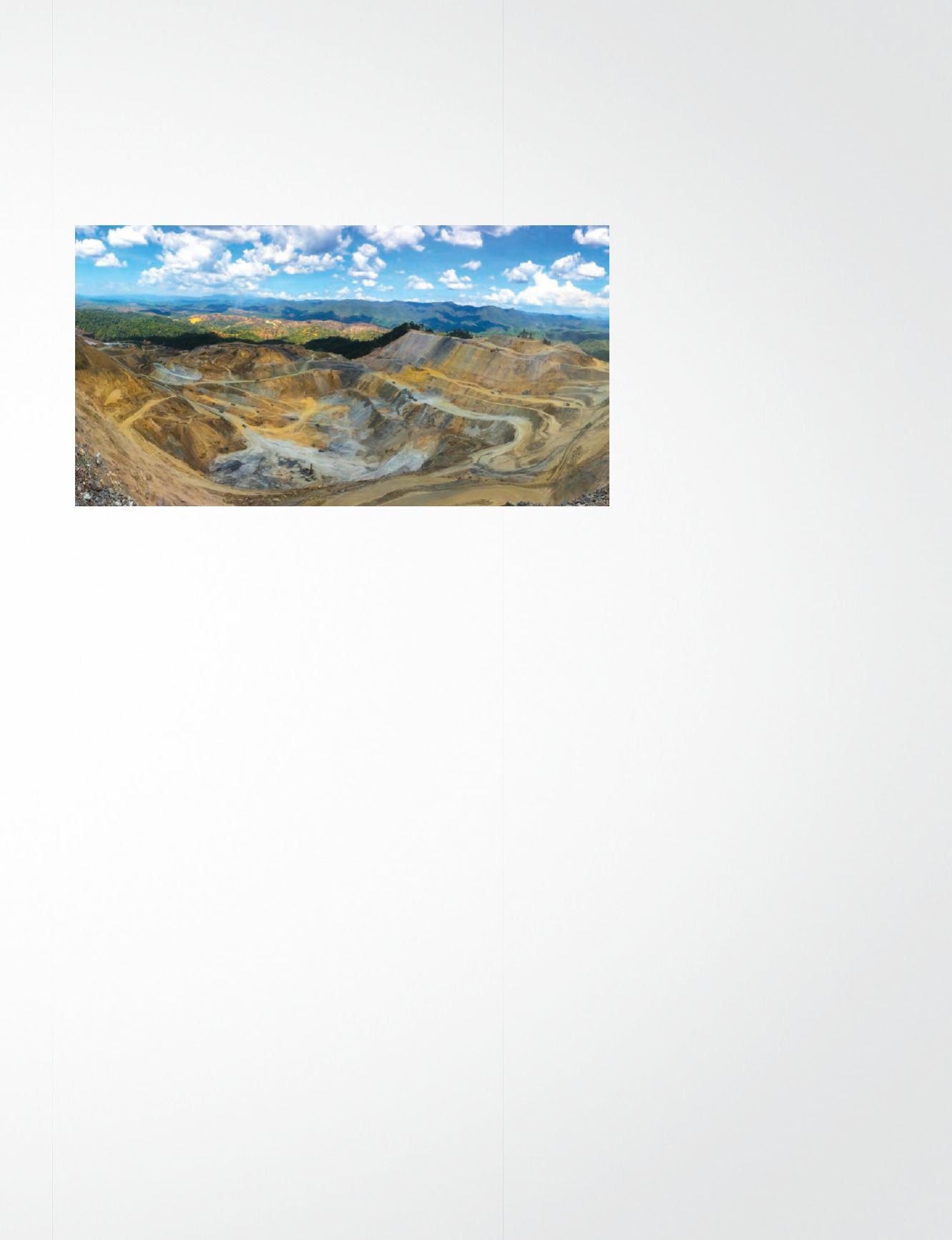

Aerial view of the Rahman Hydraulic

open pit tin mine

29

THE STRAITS TRADING COMPANY LIMITED ANNUAL REPORT 2014