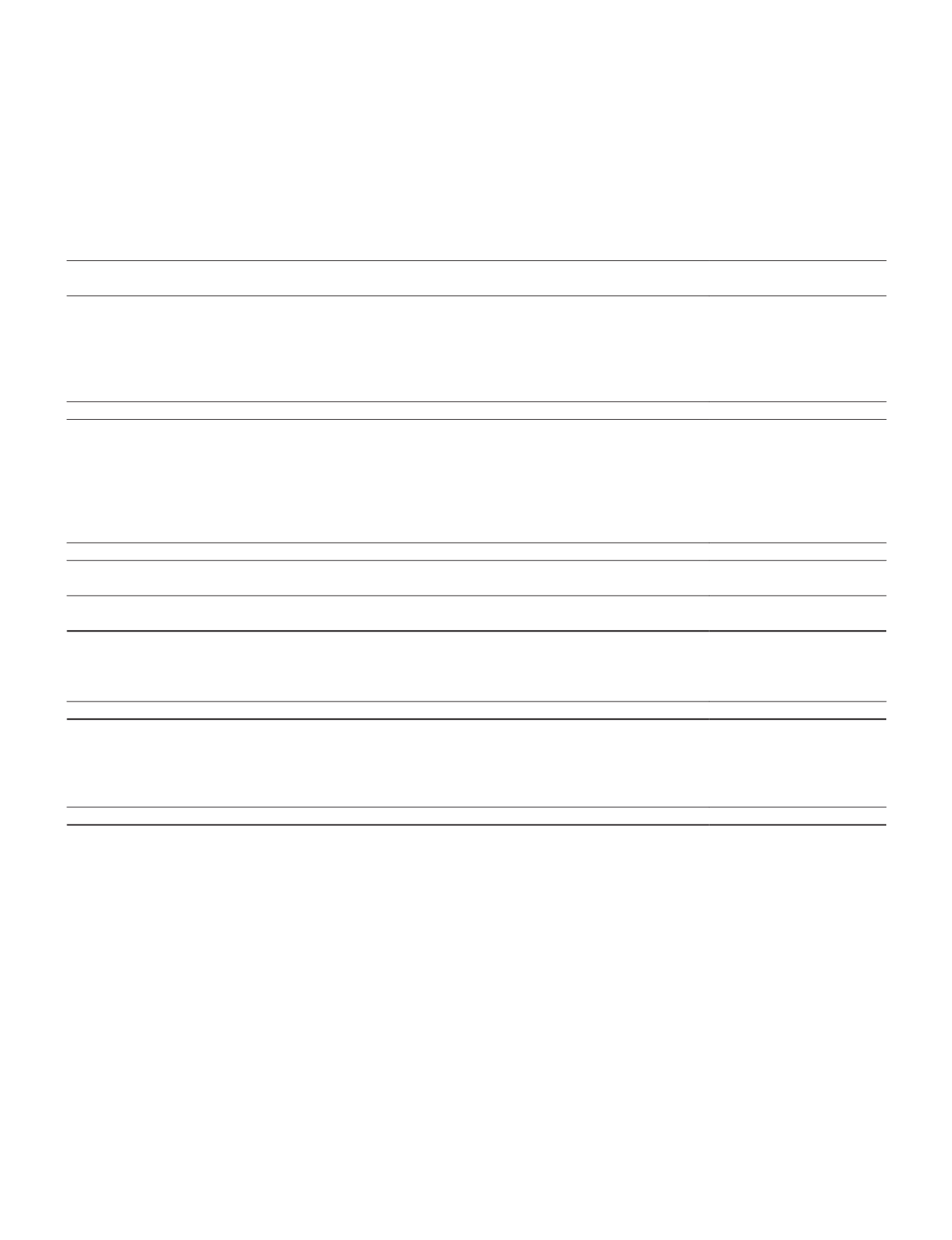

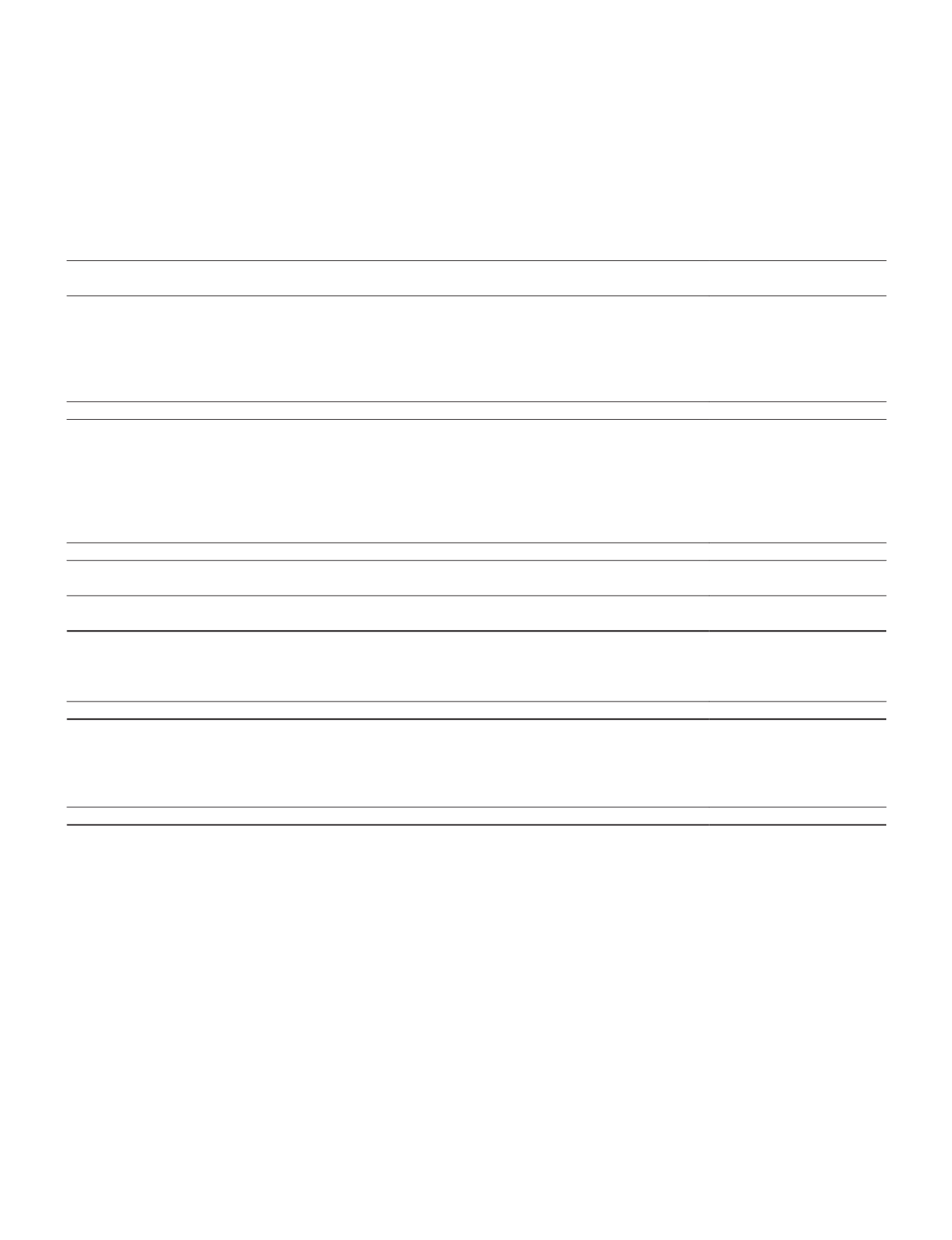

48

THE STRAITS TRADING COMPANY LIMITED

2015

2014

$’000

$’000

Profit after tax

7,485

16,194

Other comprehensive income:

Items that will not be reclassified to profit or loss:

Net revaluation surplus on property, plant and equipment

1,460

1,326

Share of revaluation surplus on property, plant and equipment of associates

6,750

5,437

8,210

6,763

Items that may be reclassified subsequently to profit or loss:

Net fair value changes in available-for-sale investment securities

(42,319)

24,422

Net fair value changes in cash flow hedges

(812)

(1,273)

Currency translation reserve

(15,296)

8,766

Share of reserves of associates and joint ventures

(9,573)

1,100

Reversal of fair value changes on investment securities re-designated as marketable securities

–

1,050

(68,000)

34,065

Other comprehensive income after tax for the year

(59,790)

40,828

Total comprehensive income for the year

(52,305)

57,022

Attributable to:

Owners of the Company

(44,162)

54,736

Non-controlling interests

(8,143)

2,286

Total comprehensive income for the year

(52,305)

57,022

Attributable to:

Owners of the Company

Total comprehensive income after tax from continuing operations

(44,162)

50,895

Total comprehensive income after tax from discontinued operations

–

3,841

Total comprehensive income for the year attributable to owners of the Company

(44,162)

54,736

CONSOLIDATEDSTATEMENTOFCOMPREHENSIVE INCOME

For the financial year ended 31 December 2015

The accompanying accounting policies and explanatory notes form an integral part of the financial statements.