NOTES TO THE FINANCIAL STATEMENTS

For the Financial Year Ended 31 December 2014

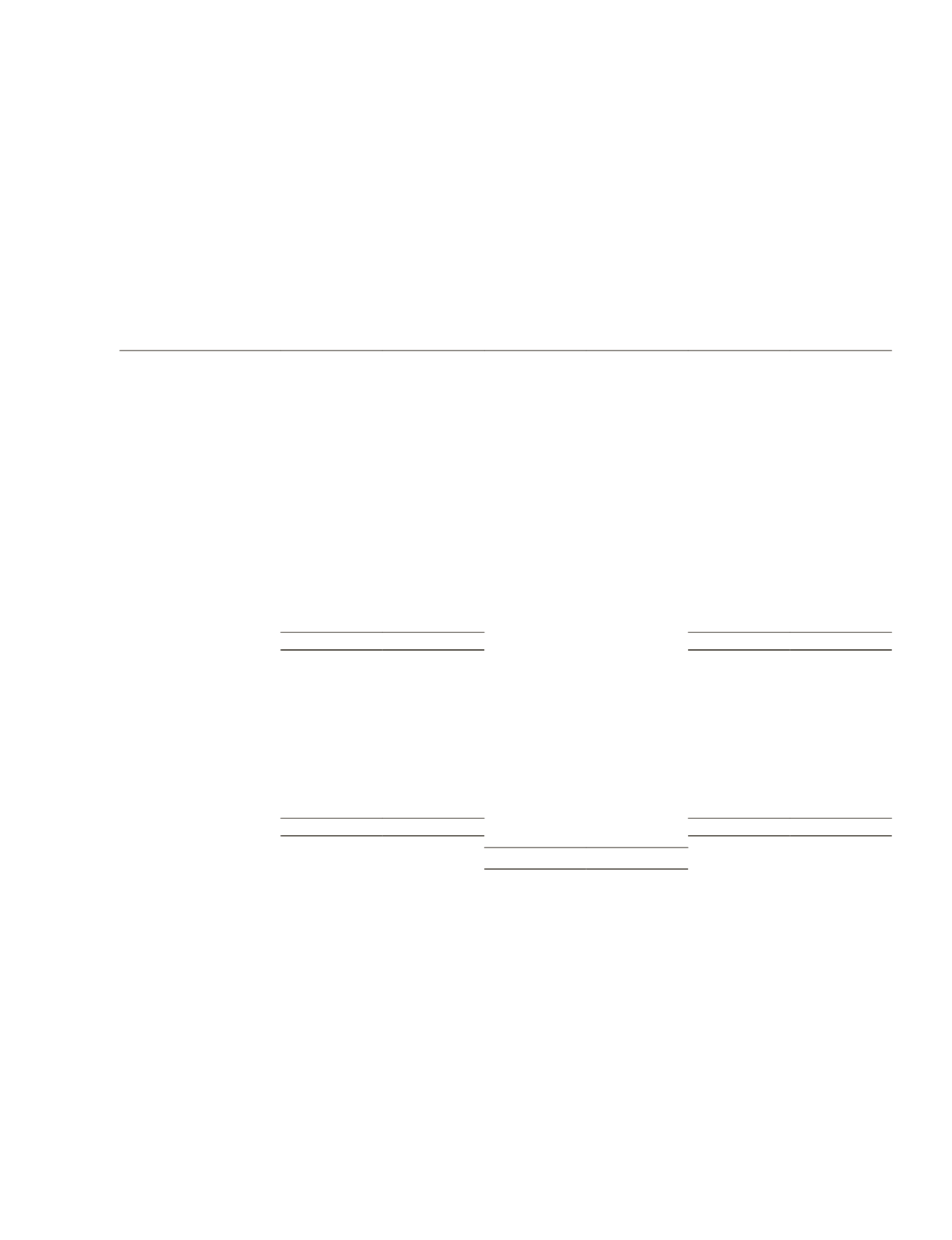

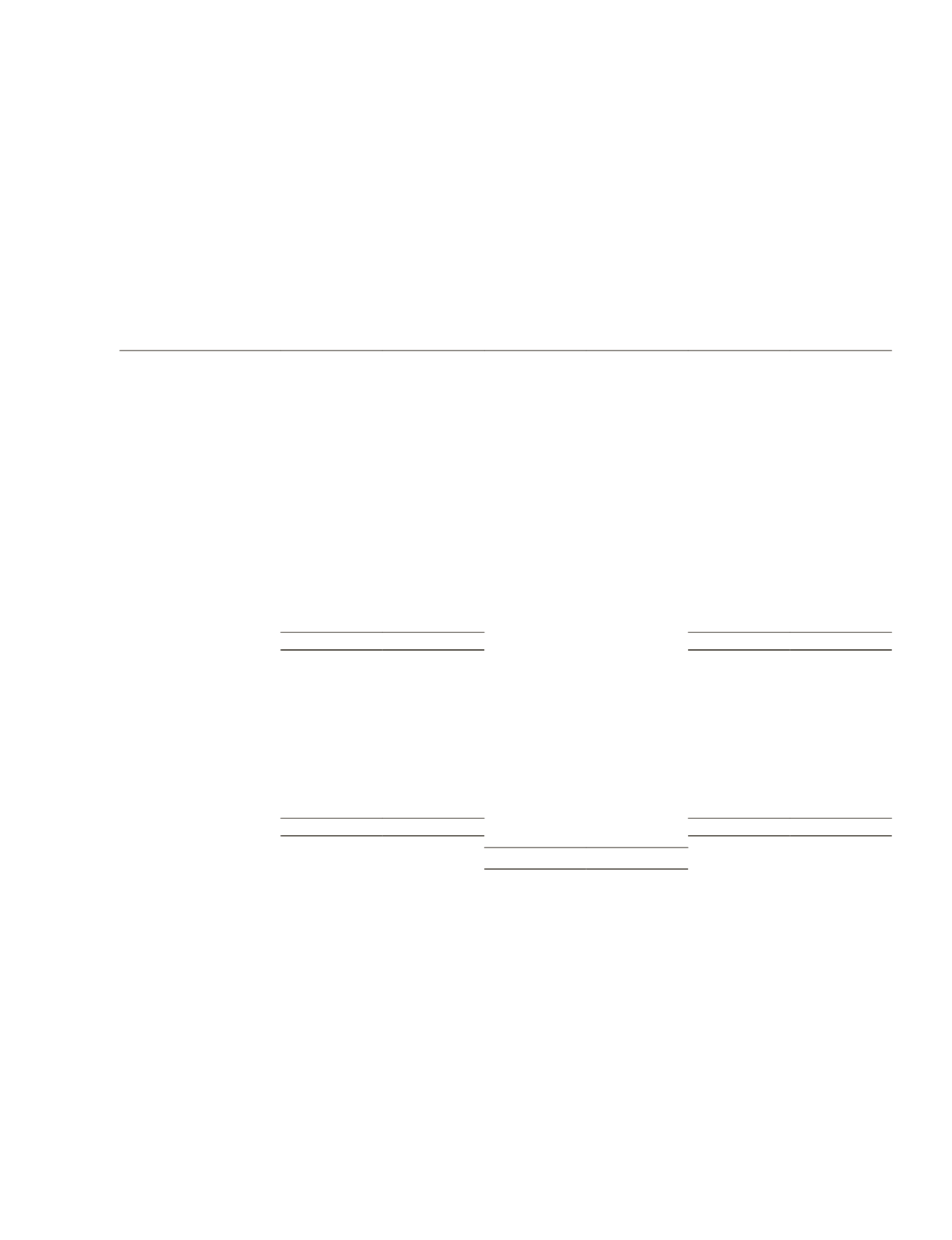

19 DEFERRED TAX ASSETS AND LIABILITIES

Group

Company

Consolidated

balance sheet

Consolidated

income statement

Balance sheet

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Deferred tax assets:

Provisions

1,477

1,810

314

305

–

–

Difference in

depreciation

(120)

(48)

31

(9)

–

–

Fair value changes on

forward currency

contracts, forward

sale contracts and

interest rate swap

contracts

557

235

54

(59)

–

–

Revaluation of property,

plant and equipment

(183)

(100)

–

–

–

–

Fair value changes on

available-for-sale

investment securities

(270)

(202)

–

–

–

–

Others

89

133

56

(59)

–

–

1,550

1,828

–

–

Deferred tax liabilities:

Difference in

depreciation

1,163

1,211

(32)

(2,103)

773

801

Unremitted foreign

income and profits

2,276

3,006

(726)

599

287

287

Fair value changes of

investment properties

2,191

2,139

92

(37,180)

2,176

2,127

Revaluation of property,

plant and equipment

421

406

–

–

55

55

Others

–

95

(79)

–

–

–

6,051

6,857

3,291

3,270

Deferred tax credit

(note 12)

(290)

(38,506)

As at 31 December 2014, certain subsidiaries have unutilised tax losses amounting to $8,935,000 (2013: $10,053,000)

available for set off against future taxable income, subject to the provisions of the Income Tax Act and agreement by the

relevant authorities, for which deferred tax assets have not been recognised.

115

THE STRAITS TRADING COMPANY LIMITED ANNUAL REPORT 2014