NOTES TO THE FINANCIAL STATEMENTS

For the Financial Year Ended 31 December 2014

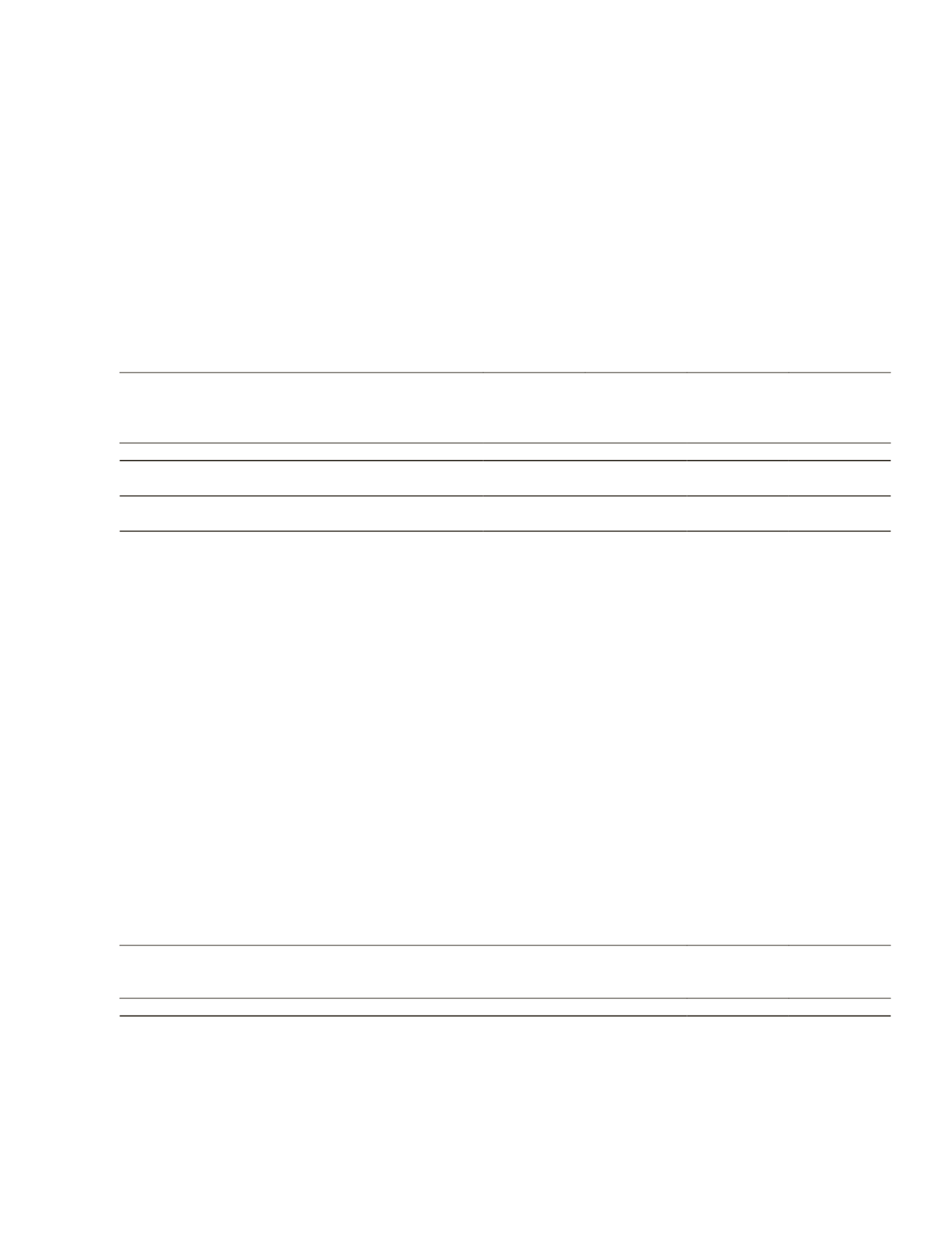

22 DERIVATIVE FINANCIAL INSTRUMENTS

Derivative financial instruments included in the balance sheet as at 31 December are as follows:

Group

2014

2014

2013

2013

Assets

Liabilities

Assets

Liabilities

$’000

$’000

$’000

$’000

Interest rate swap contracts

–

(21)

–

(62)

Forward currency contracts

–

(2,142)

–

(879)

Forward commodity contracts

–

(160)

–

–

–

(2,323)

–

(941)

Current

–

(2,142)

–

(897)

Non-current

–

(181)

–

(44)

These represent the fair values of the following financial instruments:

(a)

the interest rate swap contract is entered into for the purpose of managing interest rate risk. The fair value changes

of this contract are recognised in profit or loss.

(b)

forward currency contracts are entered into for the purpose of managing foreign exchange risk. The fair value

changes of these contracts are recognised in other comprehensive income and accumulated in equity under

hedging reserve to the extent that the hedges are effective.

(c)

forward commodity contracts are entered into for the purpose of managing commodity price risk. The fair value

changes of these contracts are recognised in other comprehensive income and accumulated in equity under

hedging reserve to the extent that the hedges are effective.

Further details of the derivative financial instruments in items (a) to (c) are disclosed in note 41 to the financial statements.

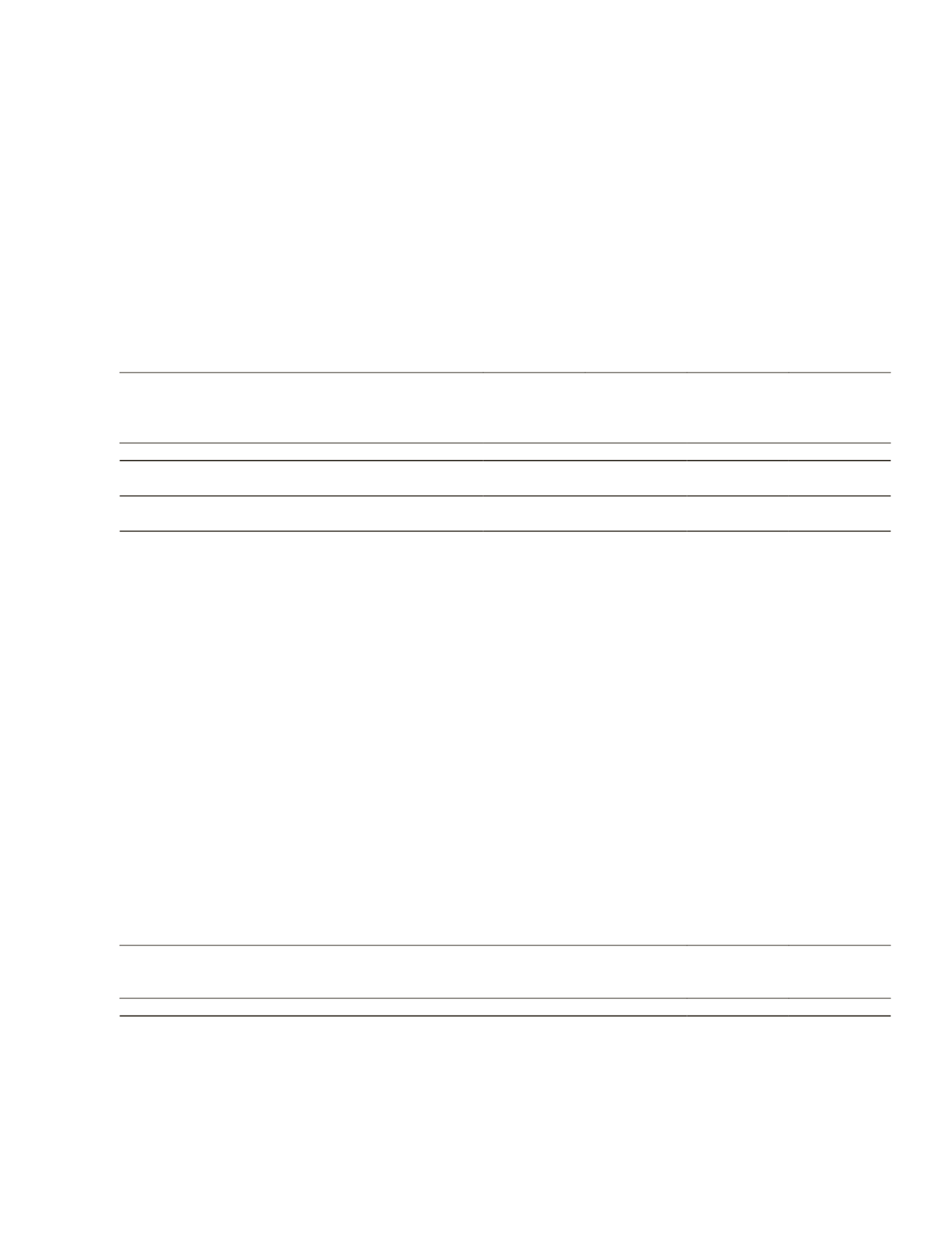

23 OTHER NON-CURRENT ASSETS

Group

2014

2013

$’000

$’000

Base inventory

1,135

1,155

Initial payment for a retail development in Chongqing

74,491

–

75,626

1,155

(a)

Base inventory is used in the smelting process and comprises a metallic tin content of 381 tonnes (2013: 381 tonnes).

It is stated at lower of estimated recoverable amount and cost.

(b)

The initial payment relates to acquisition of a retail development in Chongqing, China made by the Group in

December 2014 for approximately RMB668.4 million. The completion of the acquisition is subject to certain

precedent conditions. The Group will undertake asset enhancement initiatives costing approximately RMB100

million to fit out the mall and expects it to be operational by third quarter 2016.

121

THE STRAITS TRADING COMPANY LIMITED ANNUAL REPORT 2014