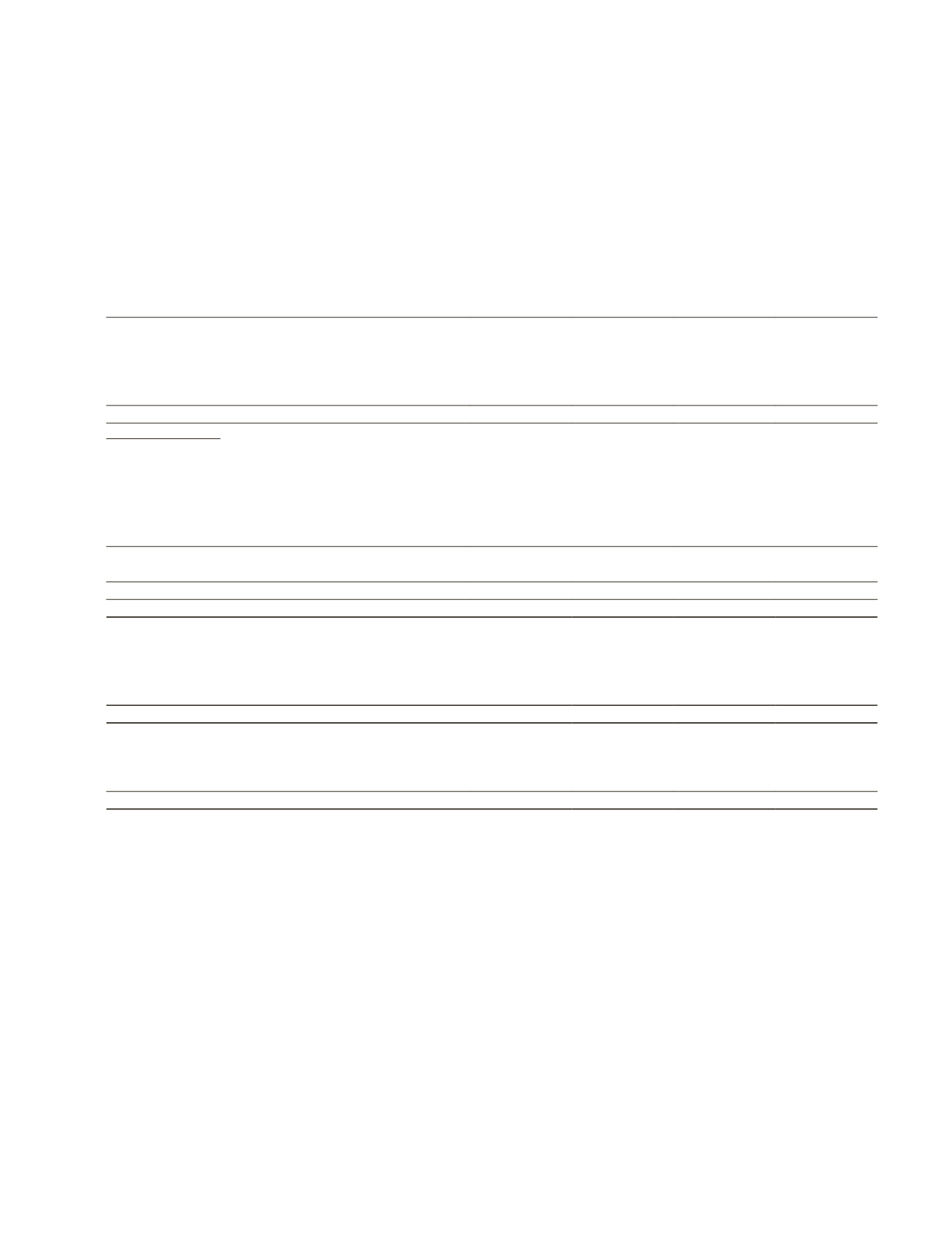

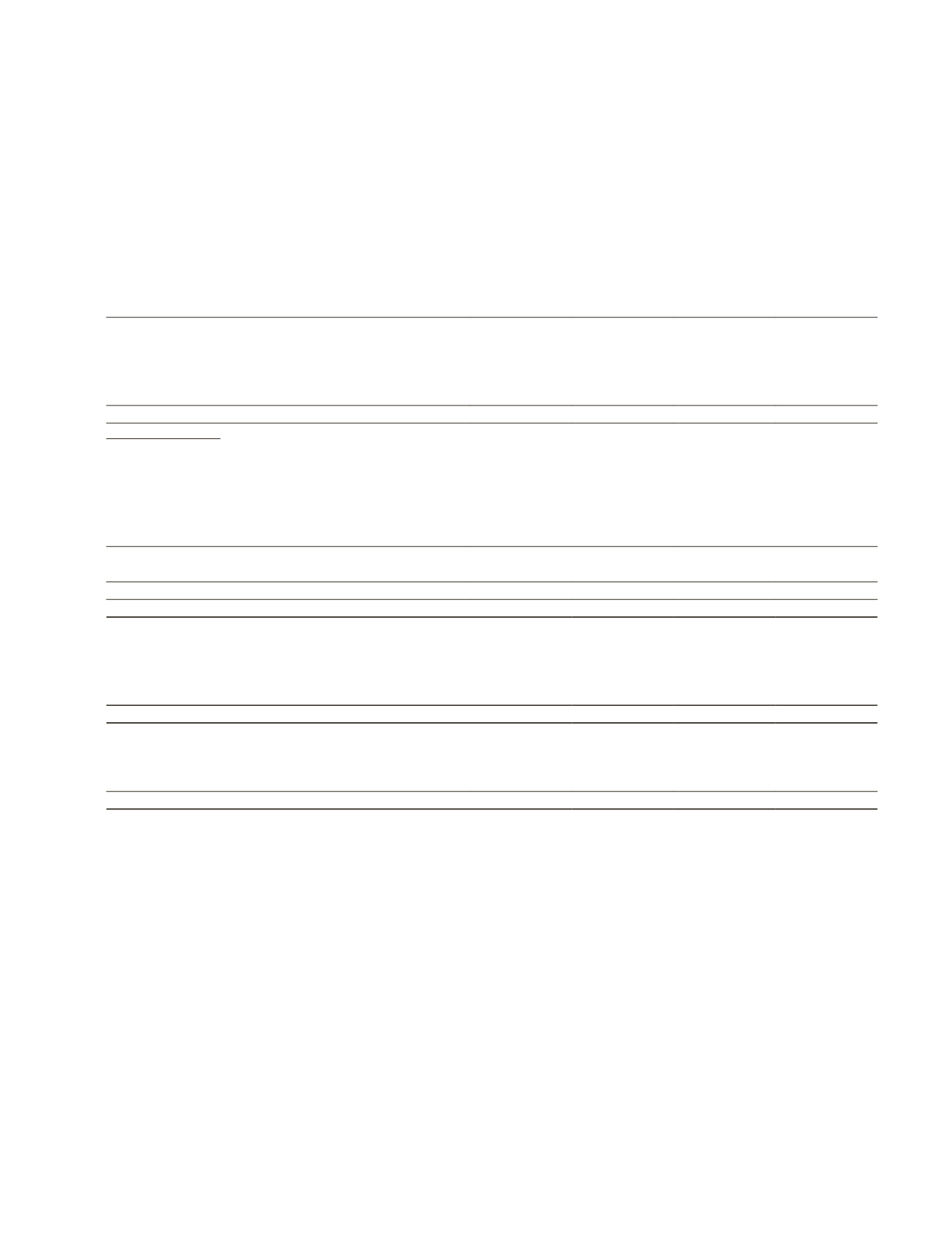

NOTES TO THE FINANCIAL STATEMENTS

For the Financial Year Ended 31 December 2014

20 TRADE AND OTHER RECEIVABLES

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Current:

Trade receivables

47,349

28,385

54

4

Amount due from an associate

616

616

–

–

Impairment of doubtful receivables

(4,875)

(3,989)

–

–

43,090

25,012

54

4

Other receivables

Balance receivable from sale of properties

–

8,415

–

–

Deposits

648

1,010

43

45

Non-trade receivables

6,194

17,348

65

35

Amounts due from subsidiaries

–

–

558,191

584,817

Amounts due from associates

67,207

67,950

10

1,225

Amounts due from joint ventures

22

105

–

–

74,071

94,828

558,309

586,122

Impairment of doubtful receivables

(3,334)

(11,580)

(284)

(406)

70,737

83,248

558,025

585,716

Trade and other receivables (current)

113,827

108,260

558,079

585,720

Non-Current:

Non-trade receivables

–

67

–

–

Amount due from joint venture

2,775

3,091

–

–

Impairment of doubtful receivables

(512)

(195)

–

–

2,263

2,963

–

–

Total trade and other receivables

(current and non-current)

116,090

111,223

558,079

585,720

Add: Cash and cash equivalents (note 28)

480,170

274,333

387,410

144,133

Total loans and receivables

596,260

385,556

945,489

729,853

Trade receivables

Trade receivables are non-interest bearing and are generally on cash payment to 90-day terms. They are recognised at

their original invoice amounts which represent their fair values on initial recognition.

At the end of the reporting period, trade receivables arising from export sales amounting to $3,216,000 (2013: $2,889,000)

are arranged to be settled via letters of credits issued by reputable banks in countries where customers are based.

Amounts due from subsidiaries

The amounts due from subsidiaries are non-trade related, unsecured, non-interest bearing and repayable on demand.

116

THE STRAITS TRADING COMPANY LIMITED ANNUAL REPORT 2014