NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

113

ANNUAL REPORT 2015

21.

TRADE AND OTHER RECEIVABLES (CONT’D)

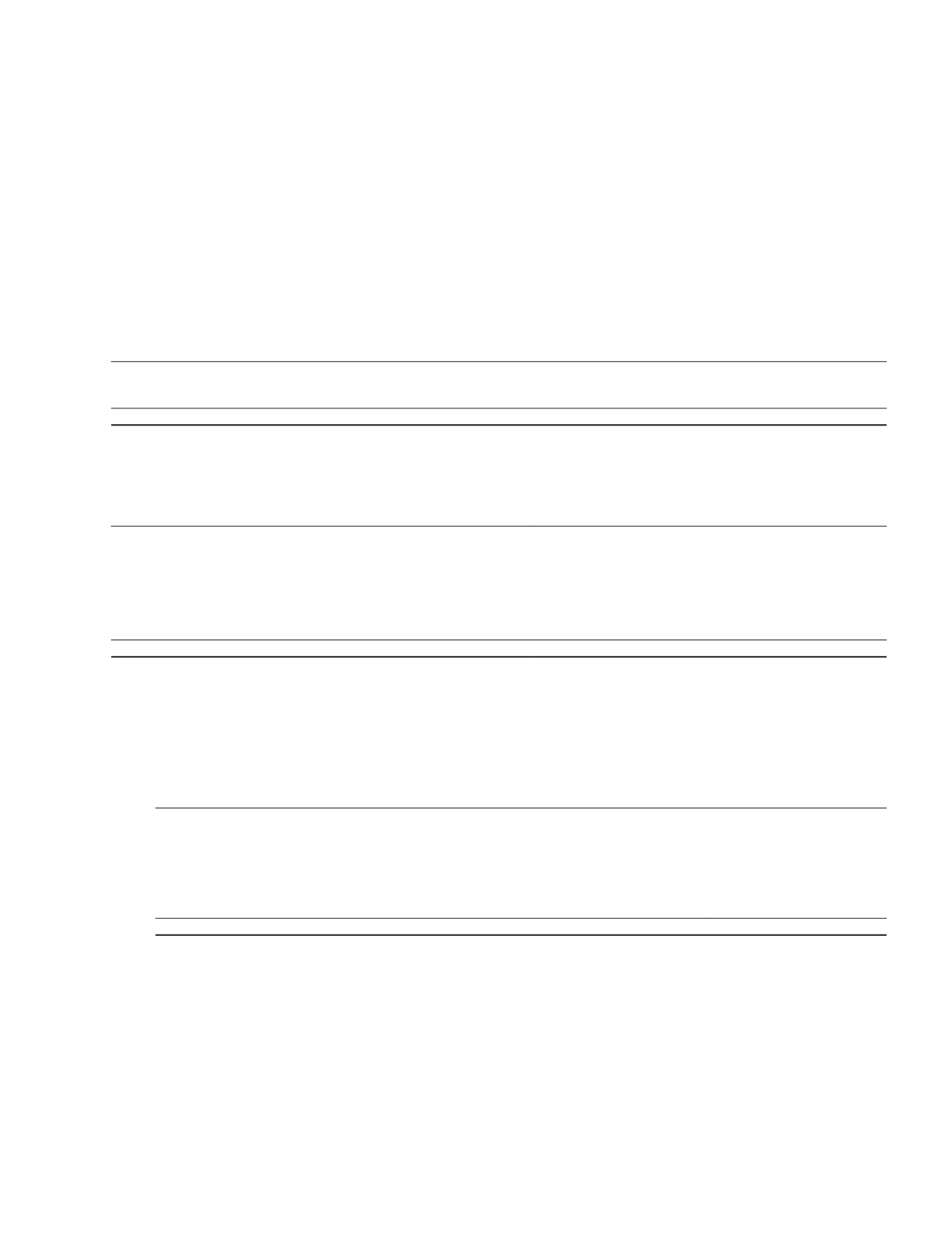

Trade and other receivables that are impaired at the reporting date and the movement of allowance accounts used to

record the impairment are as follows:

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Trade and other receivables – nominal amounts

3,452

10,979

288

672

Less: Allowance for impairment

(1,597)

(8,721)

(284)

(284)

1,855

2,258

4

388

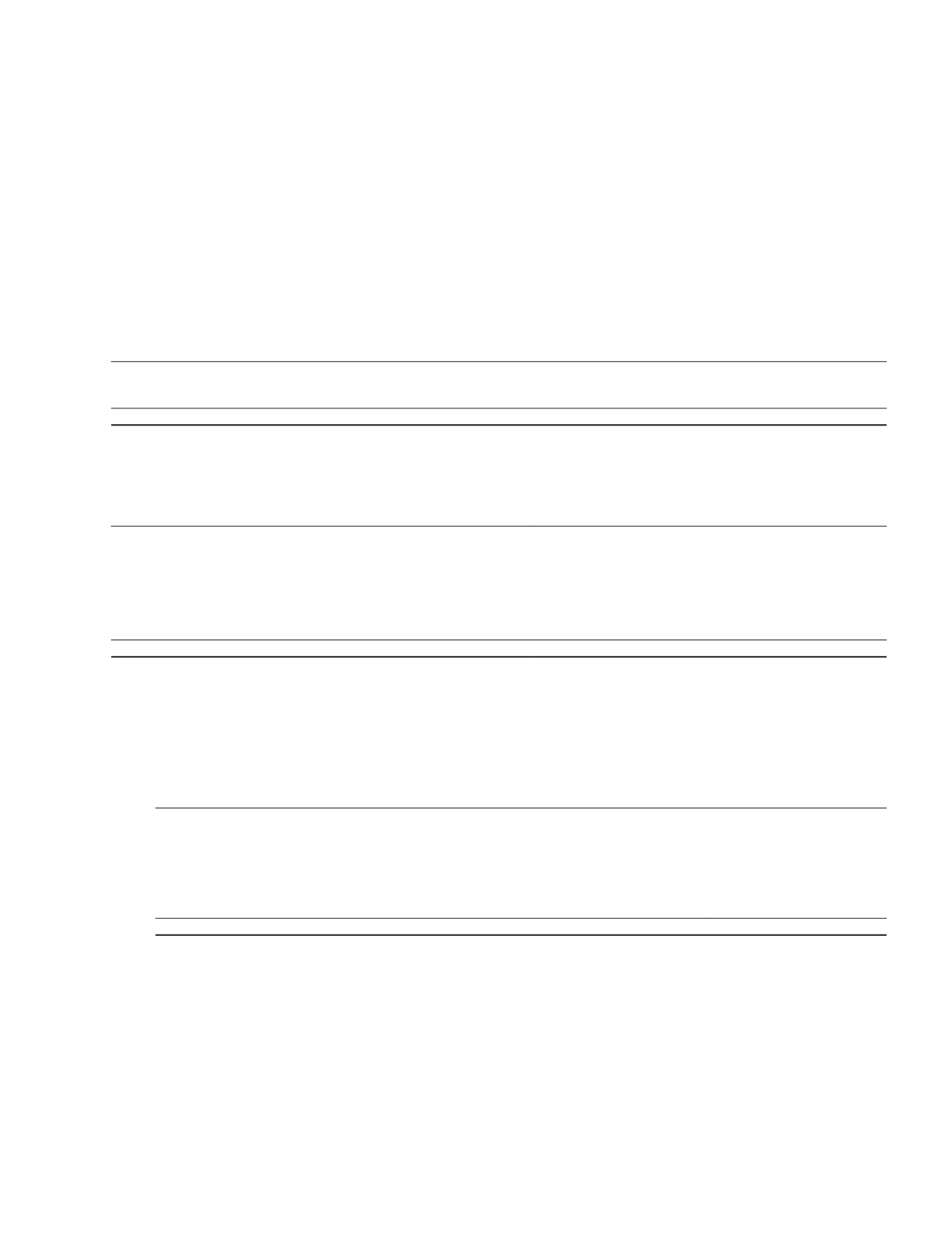

Movements in the allowance accounts:

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

At 1 January

(8,721)

(15,764)

(284)

(406)

Impairment for the year (note 11)

(1,277)

(2,397)

–

–

Amounts written off

7,290

4,519

–

21

Reversal of impairment (note 11)

11

72

–

101

Sale of a subsidiary

–

4,275

–

–

Exchange adjustment

1,100

574

–

–

At 31 December

(1,597)

(8,721)

(284)

(284)

22.

INVESTMENT SECURITIES/MARKETABLE SECURITIES

(a)

Investment Securities

Group

2015

2014

$’000

$’000

Investment Securities:

Available-for-sale equity securities

– quoted, at fair value

162,055

202,488

Held-to-maturity financial assets

– unquoted, at amortised cost

39,521

–

201,576

202,488

Information on the Group’s investment/marketable securities by country can be found in note 40(e).

The Group holds shares quoted in Singapore and Canada. Please refer to note 40(e) for information on equity

price risk.

The held-to-maturity financial assets relate to investment in a mezzanine financing amounting to A$35.0 million

with a coupon rate of 14.25% per annum and matures in August 2018.

Certain investment securities are pledged to secure bank facilities (note 32).