NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

114

THE STRAITS TRADING COMPANY LIMITED

22.

INVESTMENT SECURITIES/MARKETABLE SECURITIES (CONT’D)

(b)

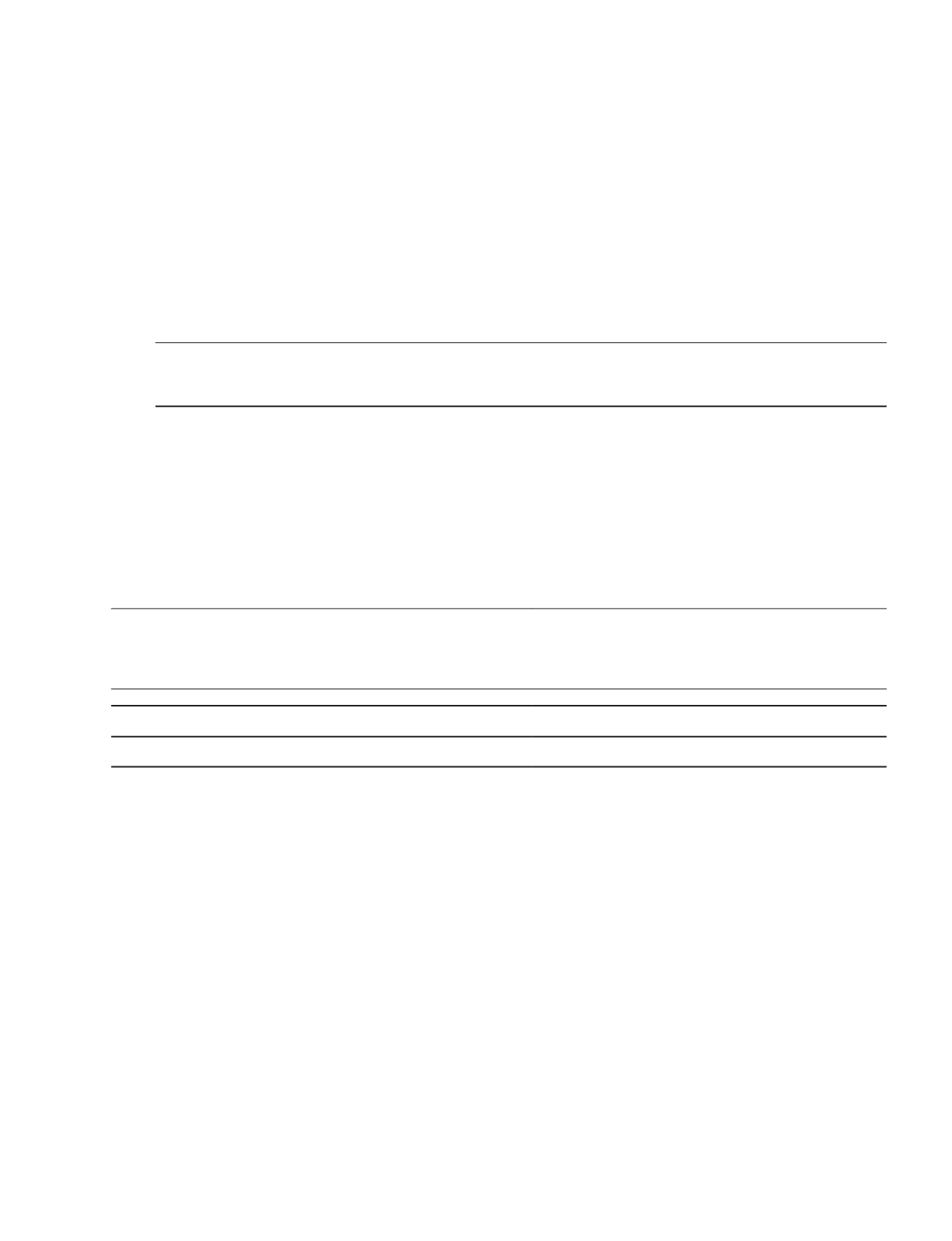

Marketable Securities

Group

2015

2014

$’000

$’000

Marketable Securities:

Held-for-trading

– quoted, at fair value

178,282

78,699

Certain marketable securities are pledged to secure bank facilities (note 32).

23.

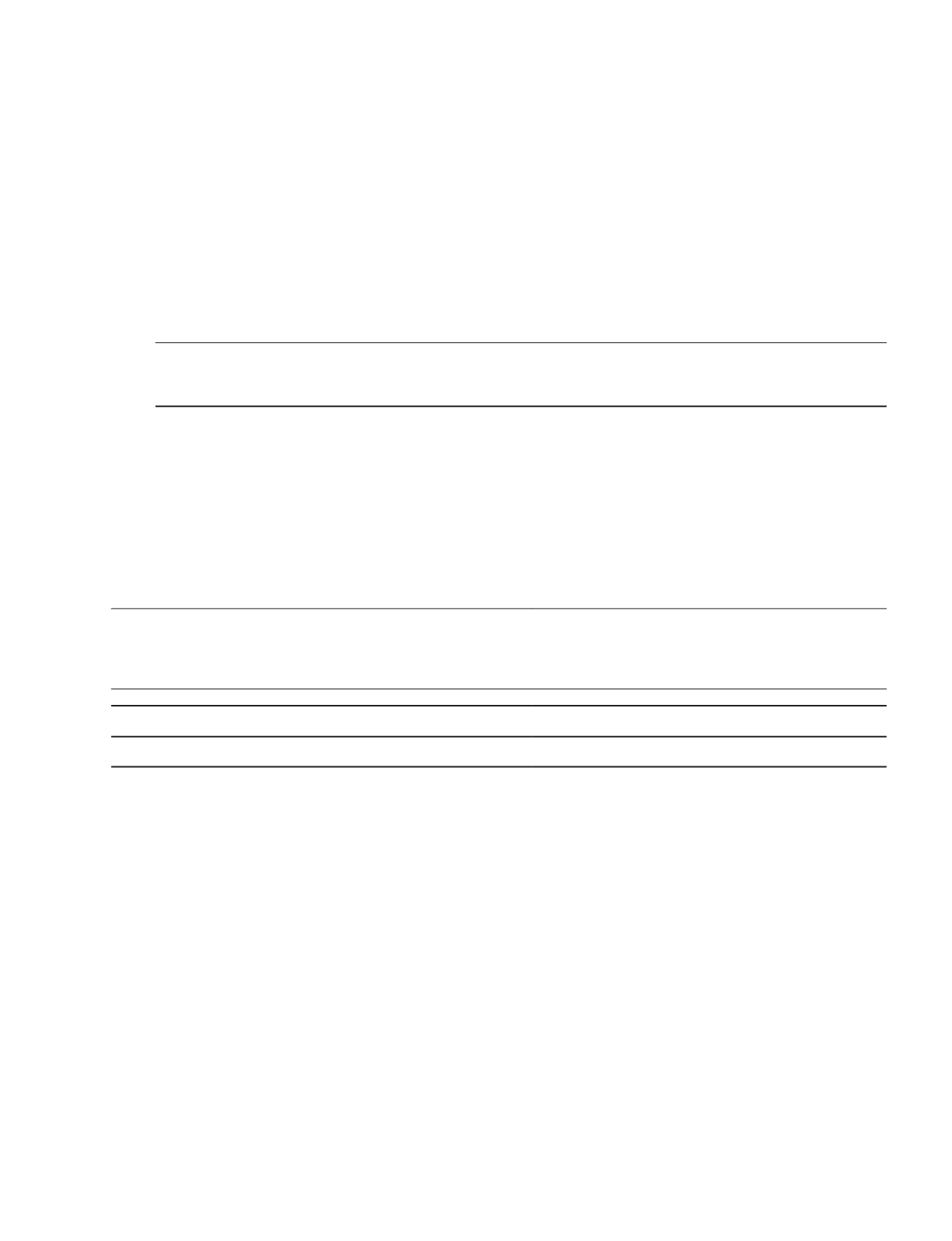

DERIVATIVE FINANCIAL INSTRUMENTS

Derivative financial instruments included in the balance sheet as at 31 December are as follows:

Group

Assets Liabilities

Assets Liabilities

2015

2015

2014

2014

$’000

$’000

$’000

$’000

Forward currency contracts

1

1,807

–

2,142

Forward commodity contracts

–

1,514

–

160

Contract for differences

199

413

–

–

Interest rate swap contracts

–

24

–

21

200

3,758

–

2,323

Current

200

3,734

–

2,142

Non-current

–

24

–

181

These represent the fair values of the following financial instruments:

(a)

forward currency contracts are entered into for the purpose of managing foreign exchange risk. For the resources

business, the fair value changes of these contracts are recognised in other comprehensive income and accumulated

in equity under hedging reserve to the extent that the hedges are effective. Gain and losses on the forward currency

contracts entered into by the fund subsidiary is recognised in profit or loss. These contracts mature between

January to December 2016.

(b)

forward commodity contracts are entered into for the purpose of managing commodity price risk. The fair value

changes of these contracts are recognised in other comprehensive income and accumulated in equity under

hedging reserve to the extent that the hedges are effective.

(c)

contract for differences (“CFDs”) represent agreements that obligate two parties to exchange cash flows at specified

intervals based upon or calculated by reference to changes in specified prices or rates for a specified amount of an

underlying asset or otherwise deemed notional amount. The payment flows are usually netted against each other,

with the difference being paid by one party to the other. Therefore amounts required for the future satisfaction of the

CFDs may be greater or less than the amount recorded. The ultimate gain or loss depends upon the prices at which the

underlying financial instruments of the CFDs is valued at the CFDs’ settlement date and is recognised in profit or loss.