NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

153

ANNUAL REPORT 2015

45.

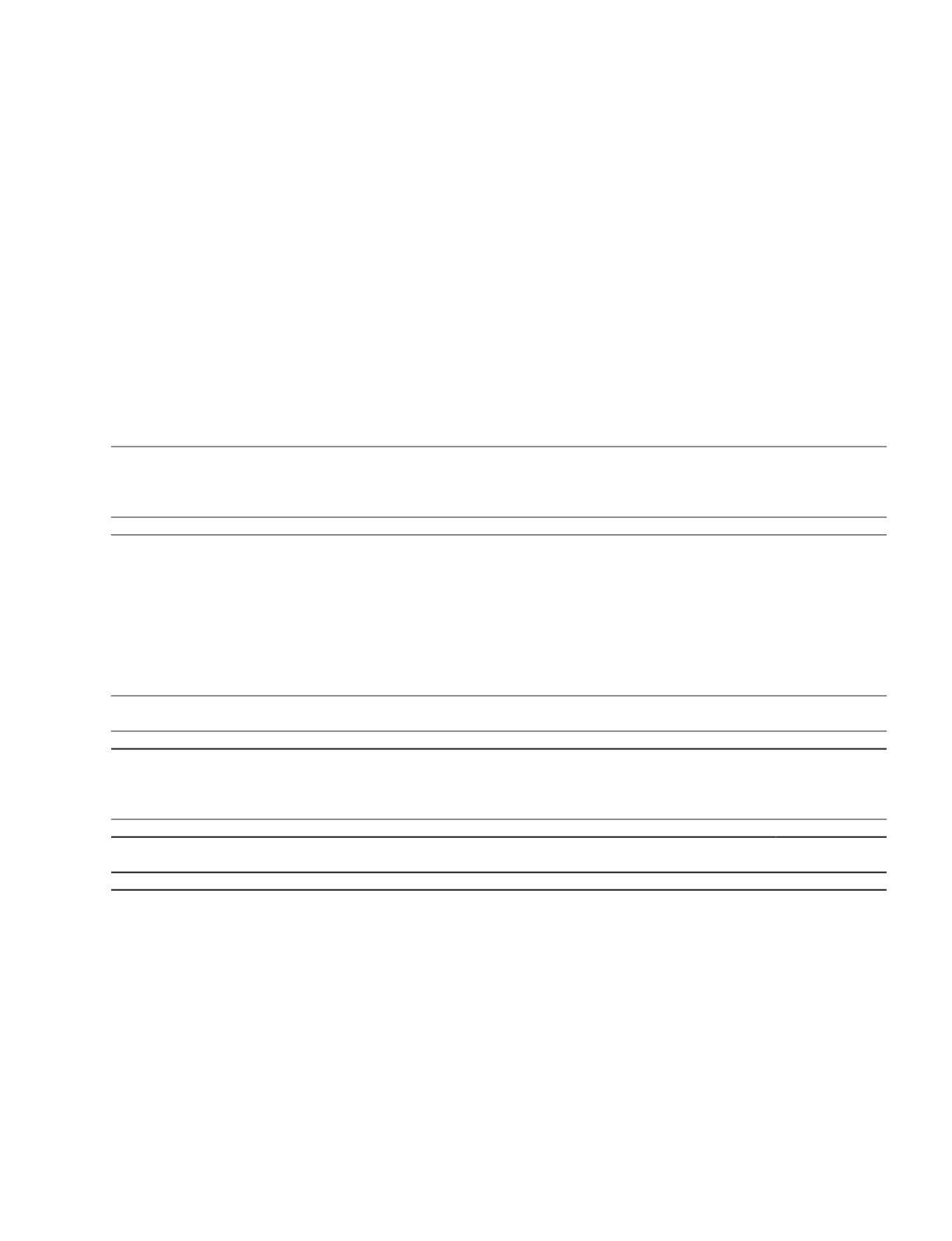

SEGMENT INFORMATION (CONT’D)

Management monitors the operating results of each business unit separately for the purpose of making decisions about

resource allocation and performance assessment. Segment performance is evaluated based on net profit, as explained in

the table below.

Transactions between operating segments are based on terms agreed between the parties.

2015 Operating Segments

Resources Real Estate Hospitality Others Elimination Consolidated

$’000

$’000

$’000 $’000

$’000

$’000

Revenue

External revenue

528,493

11,456

–

–

–

539,949

Inter-segment revenue

–

457

–

–

(457)

–

Total revenue

528,493

11,913

–

–

(457)

539,949

Segment results

Operating profit

5,247

(3,154)

(63)

1,198

–

3,228

Fair value changes in

investment properties

–

(4,819)

–

–

–

(4,819)

Impairment losses

(294)

–

–

–

–

(294)

Finance costs

(5,356)

(10,258)

– (100)

–

(15,714)

Share of results of associates

and joint ventures

600

25,575

2,300

–

–

28,475

Profit before tax

197

7,344

2,237 1,098

–

10,876

Income tax (expense)/credit

(2,801)

(3,398)

(225)

3,033

–

(3,391)

Profit/(loss) after tax

(2,604)

3,946

2,012 4,131

–

7,485

Profit/(loss) attributable to:

Owners of the Company

(1,821)

4,227

2,012 4,131

–

8,549

Non-controlling interests

(783)

(281)

–

–

–

(1,064)

(2,604)

3,946

2,012 4,131

–

7,485

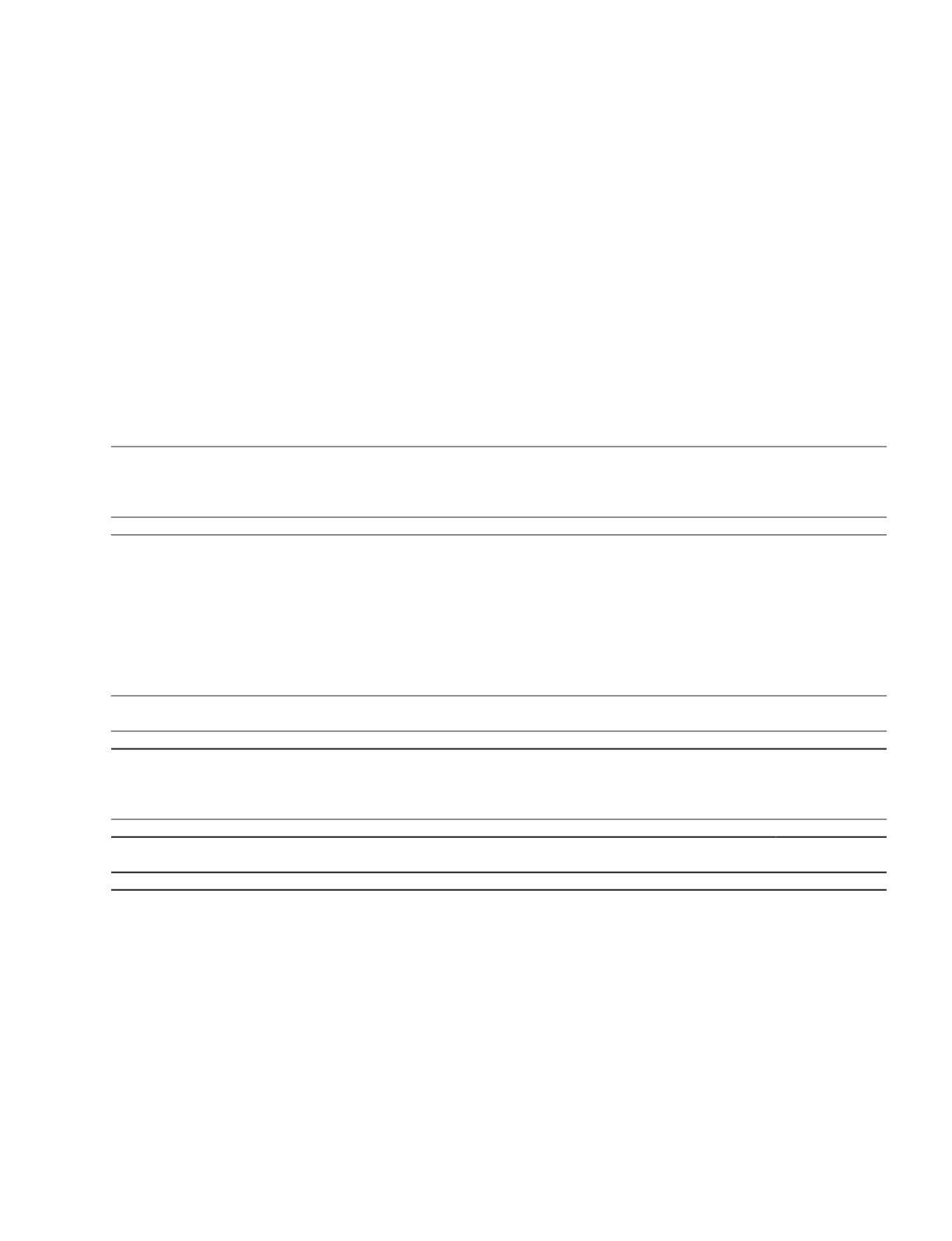

Segment Assets

283,780 1,472,869 177,053 151,779

2,085,481

Segment Liabilities

187,723 500,120

– 27,425

–

715,268

Other information:

Dividend income

– 23,757

636 1,014

–

25,407

Interest income

1,698

4,248

1,327

3,212

–

10,485

Depreciation

2,637

543

–

7

–

3,187

Amortisation

687

–

–

–

–

687

Other material non-cash items:

Impairment of associates

and joint venture

192

–

–

–

–

192

Impairment of available-for-sale

investment securities

109

–

–

–

–

109

Revaluation surplus of properties

(7)

–

–

–

–

(7)

Associates and joint ventures

26,875 430,446 101,295

–

–

558,616

Additions to non-current assets

5,061

217,059

–

–

–

222,120