NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

150

THE STRAITS TRADING COMPANY LIMITED

43.

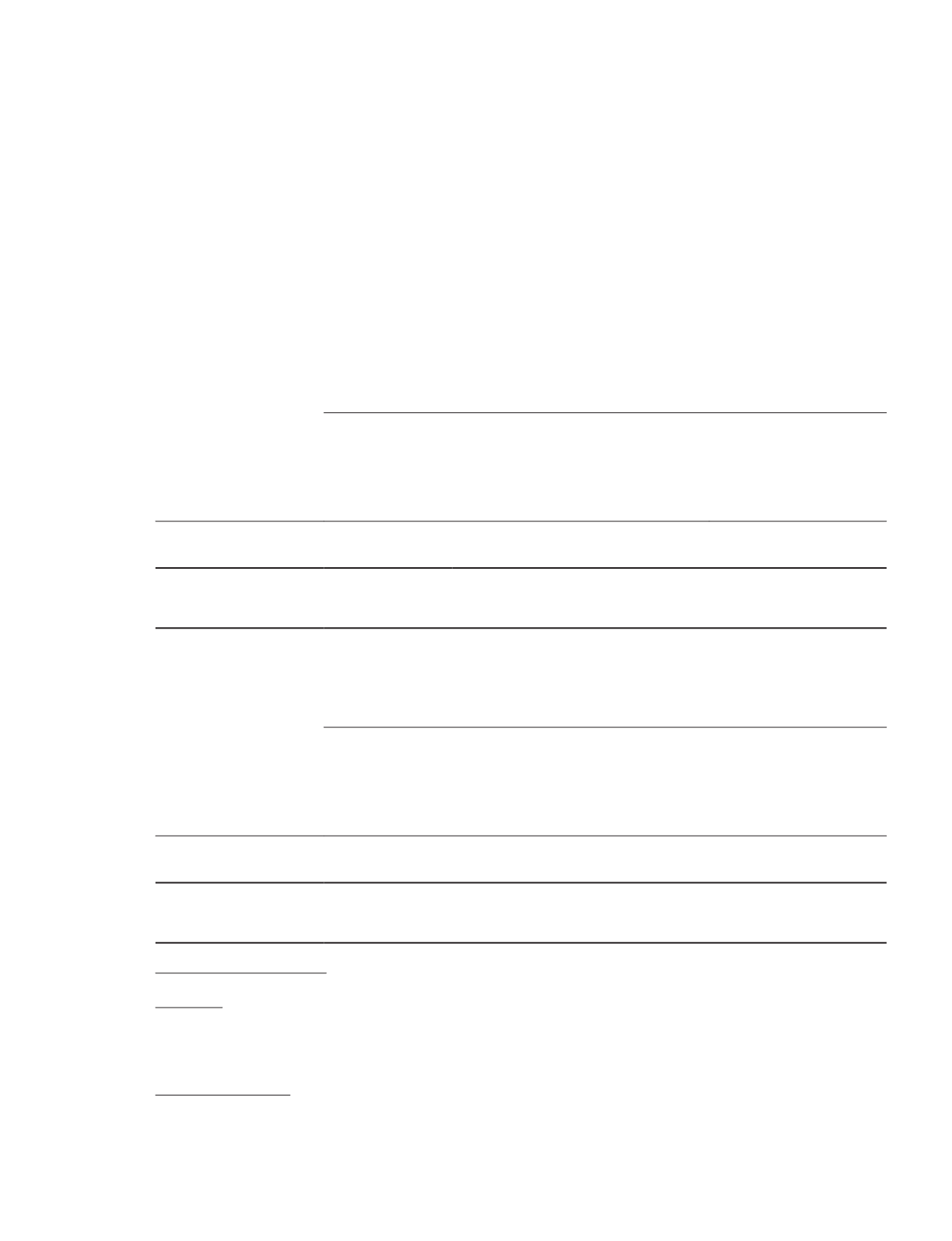

FAIR VALUE OF ASSETS AND LIABILITIES (CONT’D)

E.

Assets and liabilities not carried at fair value but for which fair value is disclosed

The following tables show an analysis of the assets and liabilities not measured at fair value at 31 December 2015

but for which fair value is disclosed:

Group

2015

$’000

Fair value measurements at the end of the reporting period using

Quoted prices

in active

markets for

identical

instruments

Significant

observable

inputs other

than quoted

prices

Significant

unobservable

inputs

Total

Carrying

Amount

(Level 1)

(Level 2)

(Level 3)

Assets

Associates

235,566

–

– 235,566 339,396

Liabilities

Fixed rate bank loans

–

–

217,921

217,921

219,415

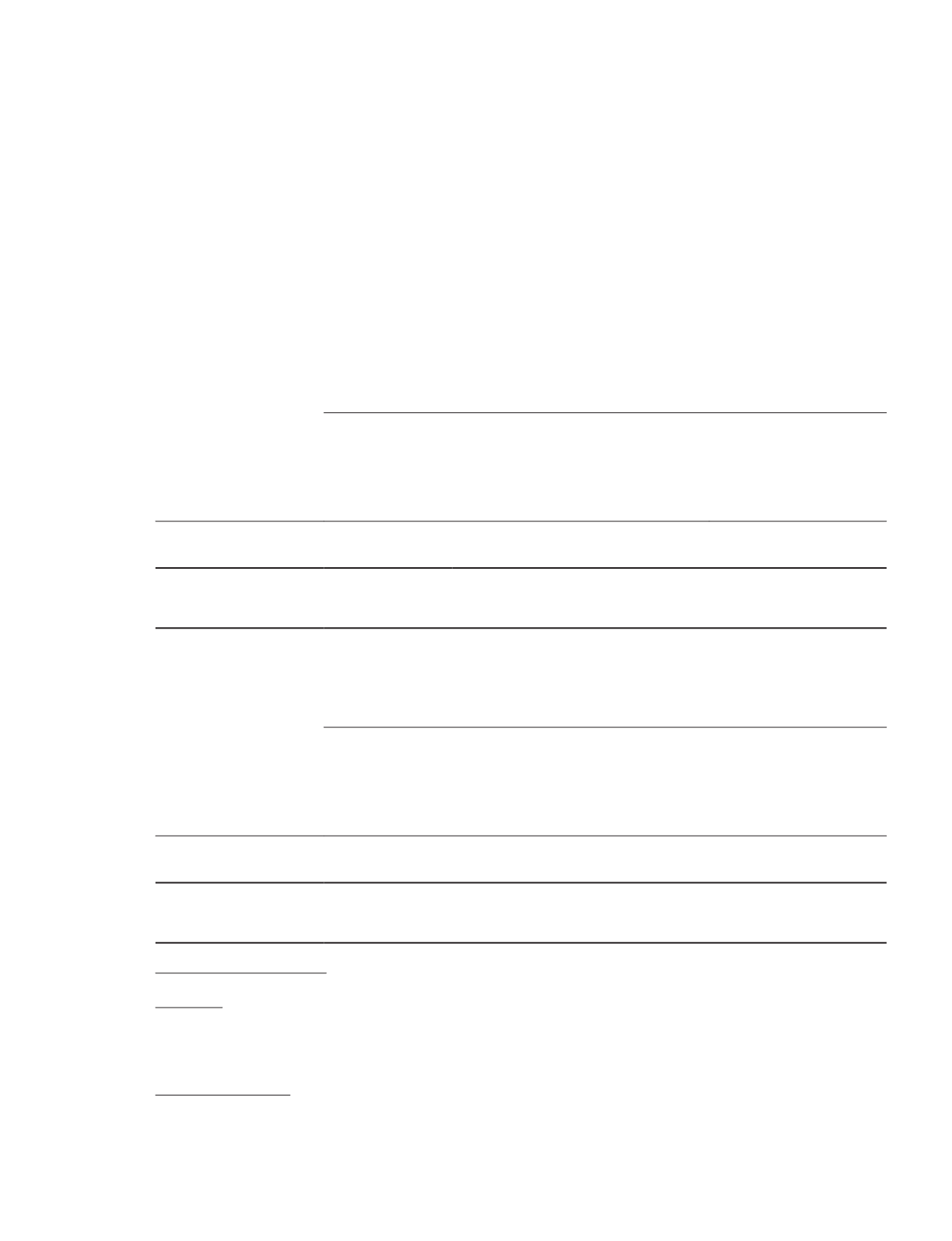

Group

2014

$’000

Fair value measurements at the end of the reporting period using

Quoted prices

in active

markets for

identical

instruments

Significant

observable

inputs other

than quoted

prices

Significant

unobservable

inputs

Total

Carrying

Amount

(Level 1)

(Level 2)

(Level 3)

Assets

Associates

288,830

–

– 288,830 305,042

Liabilities

Fixed rate bank loans

–

–

221,558 221,558 219,030

Determination of fair value

Associates

The fair value as disclosed in the table above is the price on the last trading day in the Singapore Exchange Securities

Trading Limited (SGX-ST).

Fixed rate bank loans

The fair value as disclosed in the table above is estimated based on the present value of future cash flows, discounted

at the market rate of interest for similar types of lending or borrowings at the end of the reporting period.