NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

84

THE STRAITS TRADING COMPANY LIMITED

13.

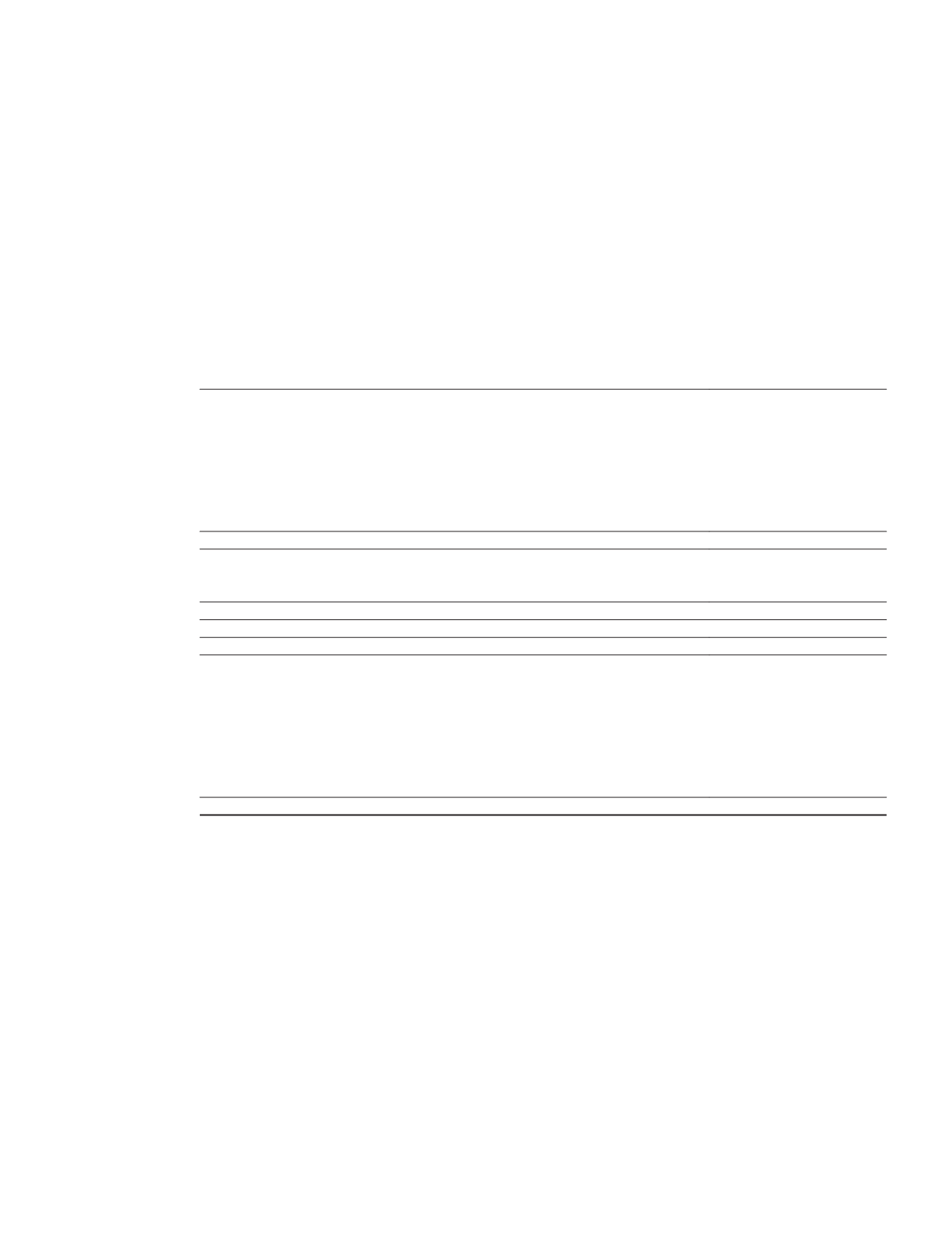

INCOME TAX EXPENSE

(a)

Major components of income tax expense

The major components of income tax expense for the years ended 31 December 2015 and 2014 are:

Group

2015

2014

$’000

$’000

(i)

Consolidated income statement:

Income tax

– Current income tax

5,932

9,317

– (Over)/Under provision in respect of prior years

(1,948)

351

– Benefits from previously unrecognised tax losses and

unutilised capital allowances

(451)

(194)

3,533

9,474

Deferred tax

– Originating and reversal of temporary differences

254

(326)

– (Over)/Under provision in respect of prior years

(396)

36

(note 20)

(142)

(290)

Income tax expense recognised in profit or loss*

3,391

9,184

(ii)

Statement of comprehensive income:

Deferred tax related to other comprehensive income

– Net change on revaluation of property, plant and equipment

209

161

– Net change in hedging reserve for derivatives designated

as hedging instruments in cash flow hedges

(246)

(427)

– Net change in available-for-sale investment securities

(183)

72

(220)

(194)

* Includes reversal of income tax provision and deferred tax liabilities of $1.9 million and $1.2 million

respectively relating to discontinued operations that were no longer required.