NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

93

ANNUAL REPORT 2015

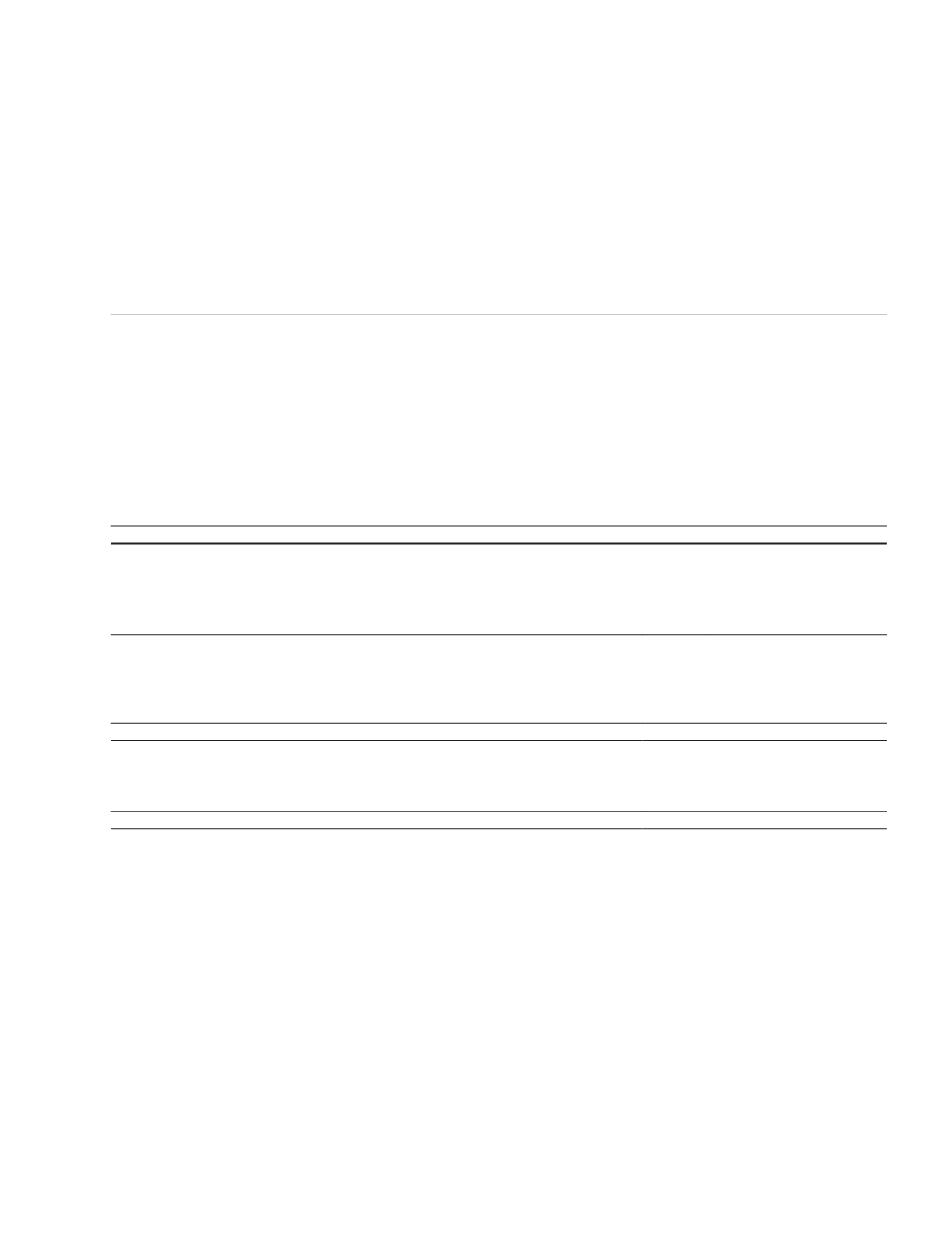

16.

INVESTMENT PROPERTIES

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Balance sheets:

At fair value:

Balance as at 1 January

399,763

849,910

53,135

122,346

Fair value changes recognised in profit or loss

(4,819)

(4,021)

4,188

1,484

Acquisition of properties

216,777

–

–

–

Reclassify from non-current assets (note 24)

74,491

–

–

–

Redevelopment expenditure

–

2,173

–

–

Disposal of a subsidiary (note 18)

(53,778)

–

–

–

Attributable to disposal group classified as held for sale (note 25)

(17,771)

(42,317)

(17,771)

–

Disposal during the year

–

(405,000)

–

(69,741)

Exchange adjustment

(8,653)

(982)

(7,181)

(954)

Balance as at 31 December

606,010

399,763

32,371

53,135

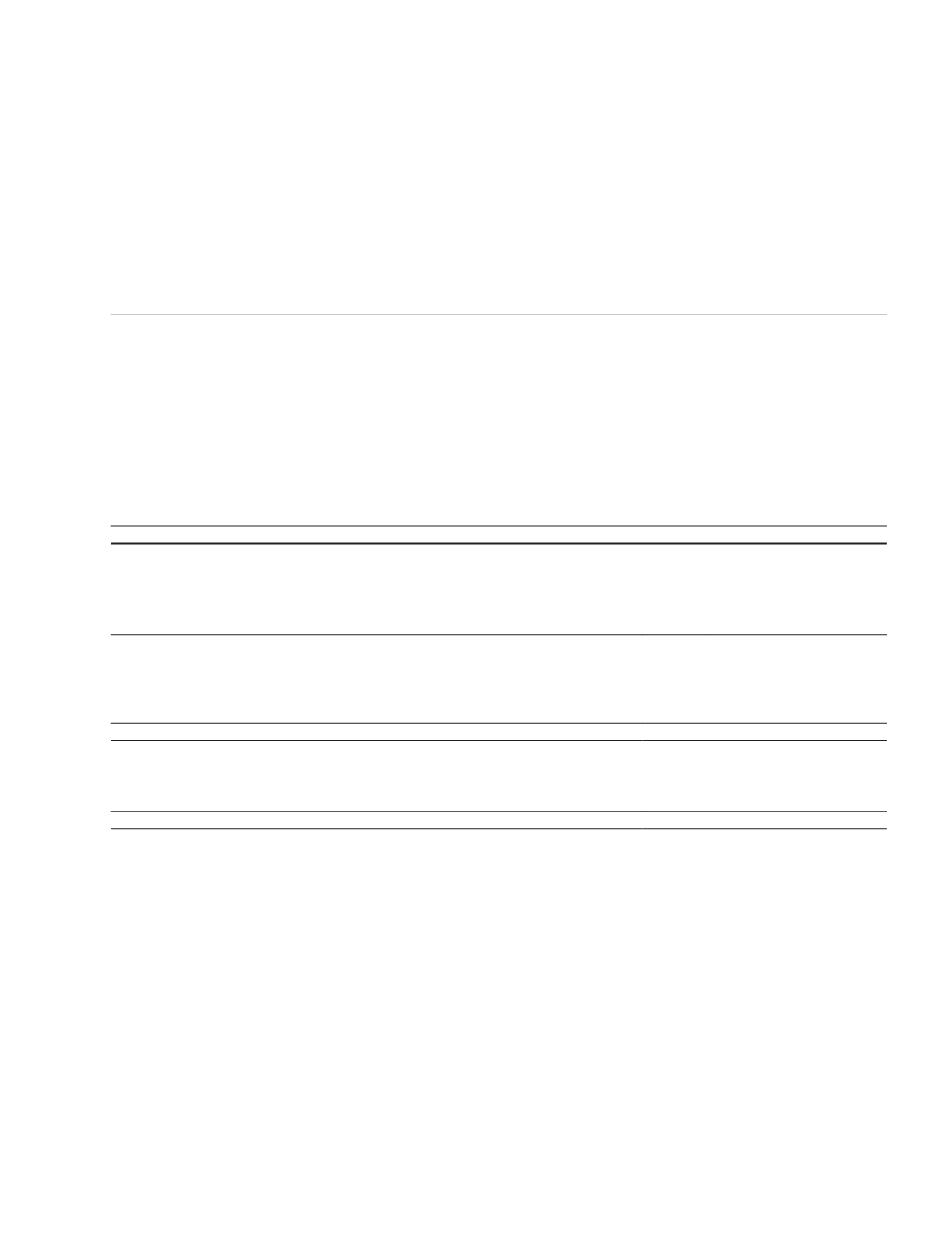

Group

2015

2014

$’000

$’000

Income statement:

Rental income from investment properties:

– Minimum lease payments

10,301

20,086

– Contingent rent based on tenant’s turnover

–

8

10,301

20,094

Direct operating expenses (including repairs and maintenance) arising from:

– Rental generating properties

(5,474)

(8,355)

– Non-rental generating properties

(9)

(8)

(5,483)

(8,363)

(a)

Except as disclosed in note 16(c), the Group has no restrictions on the realisability of its investment properties.

(b)

Investment properties are stated at fair value. Valuations of investment properties have been determined based on

valuations at or approximate the end of the reporting period. Valuations are performed by accredited independent

valuers with recent experience in the location and category of the properties being valued. Details of valuation

techniques and inputs used are disclosed in note 43D.

(c)

Certain investment properties are mortgaged to secure bank facilities (note 32).

(d)

During the financial year, the loan secured on the 14 residential units at The Holland Collection, Singapore was

repaid and the mortgage was discharged.

(e)

During the financial year, there was no employee benefits expense capitalised in investment properties (2014: $15,000)

(note 8).