NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

142

THE STRAITS TRADING COMPANY LIMITED

42.

SIGNIFICANT ACCOUNTING ESTIMATES AND JUDGEMENTS (CONT’D)

(b)

Judgements (cont’d)

(i)

Income taxes

(cont’d)

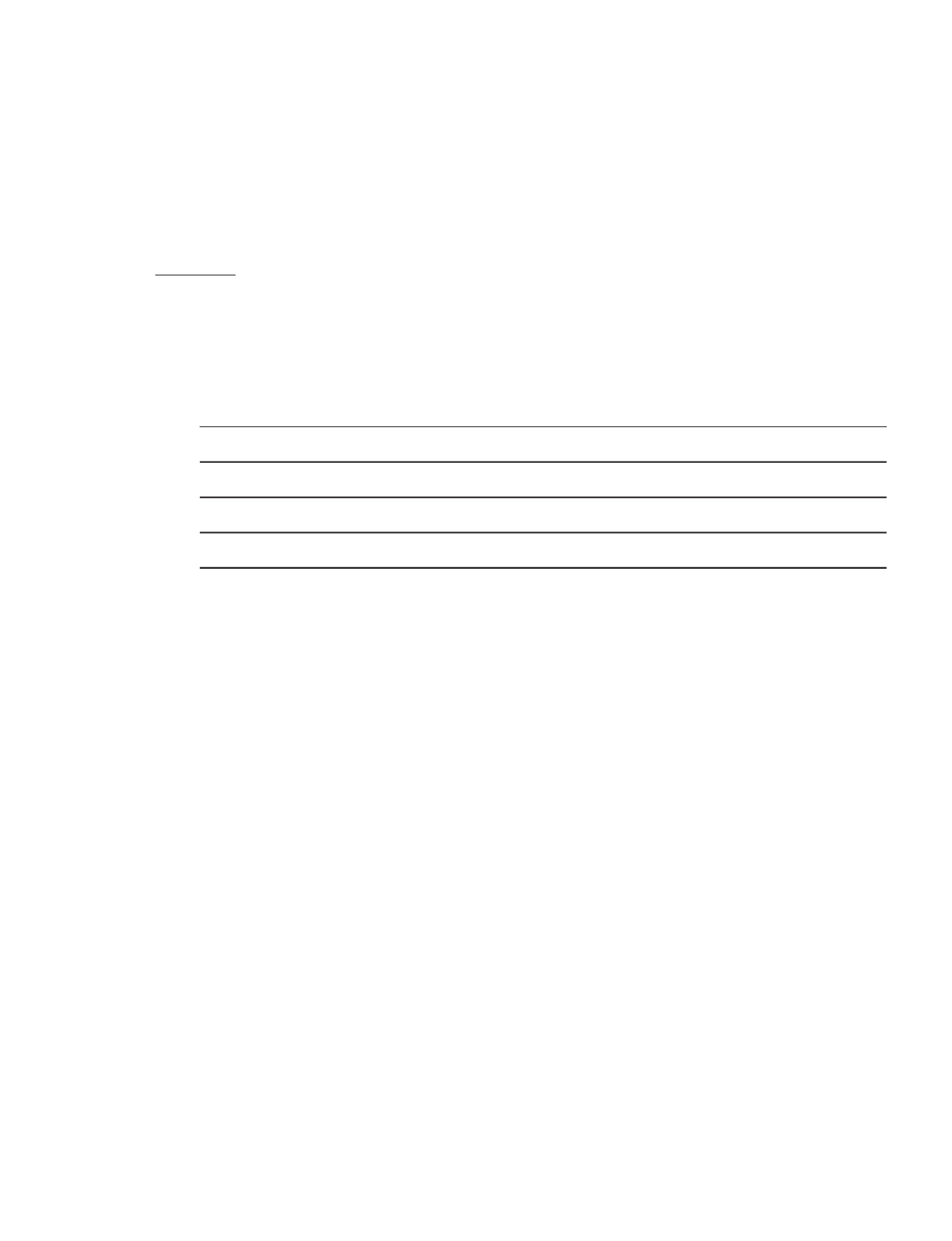

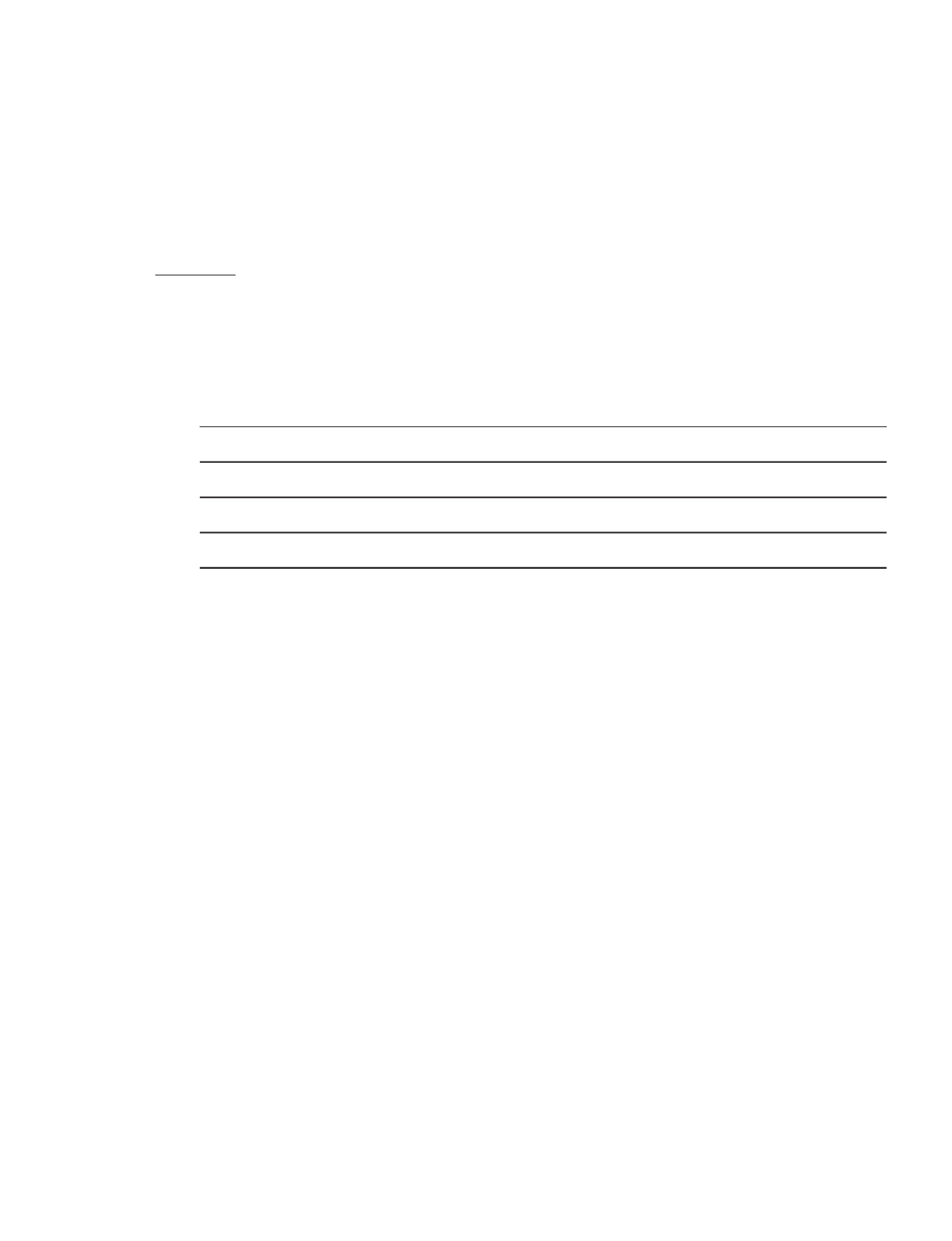

The carrying amounts are as follows:

Group

2015

2014

$’000

$’000

Income tax receivables

3,526

1,368

Income tax payable

2,083

1,682

Deferred tax assets

1,599

1,550

Deferred tax liabilities

5,654

6,051

(ii)

Impairment of investment securities

The Group reviews its equity investments classified as available-for-sale investments at each reporting date

to assess whether they are impaired. The Group records impairment charges on available-for-sale equity

investments when there has been a significant or prolonged decline in the fair value below their cost.

The determination of what is significant or prolonged requires judgement. In making this judgement, the

Group evaluates, among other factors, historical share price movements and the duration and extent to

which the fair value of an investment is less than its cost.

43.

FAIR VALUE OF ASSETS AND LIABILITIES

A.

Fair value hierarchy

The Group categories fair value measurements using a fair value hierarchy that is dependent on the valuation inputs

used as follows:

Level 1 – Quoted prices (unadjusted) in active market for identical assets or liabilities that the Group can access at

the measurement date,

Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either

directly or indirectly, and

Level 3 – Unobservable inputs for the asset or liability.

Fair value measurements that use inputs of different hierarchy levels are categorised in its entirety in the same level

of the fair value hierarchy as the lowest level input that is significant to the entire measurement.