NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

132

THE STRAITS TRADING COMPANY LIMITED

40.

FINANCIAL RISK MANAGEMENT (CONT’D)

(b)

Interest rate risk (cont’d)

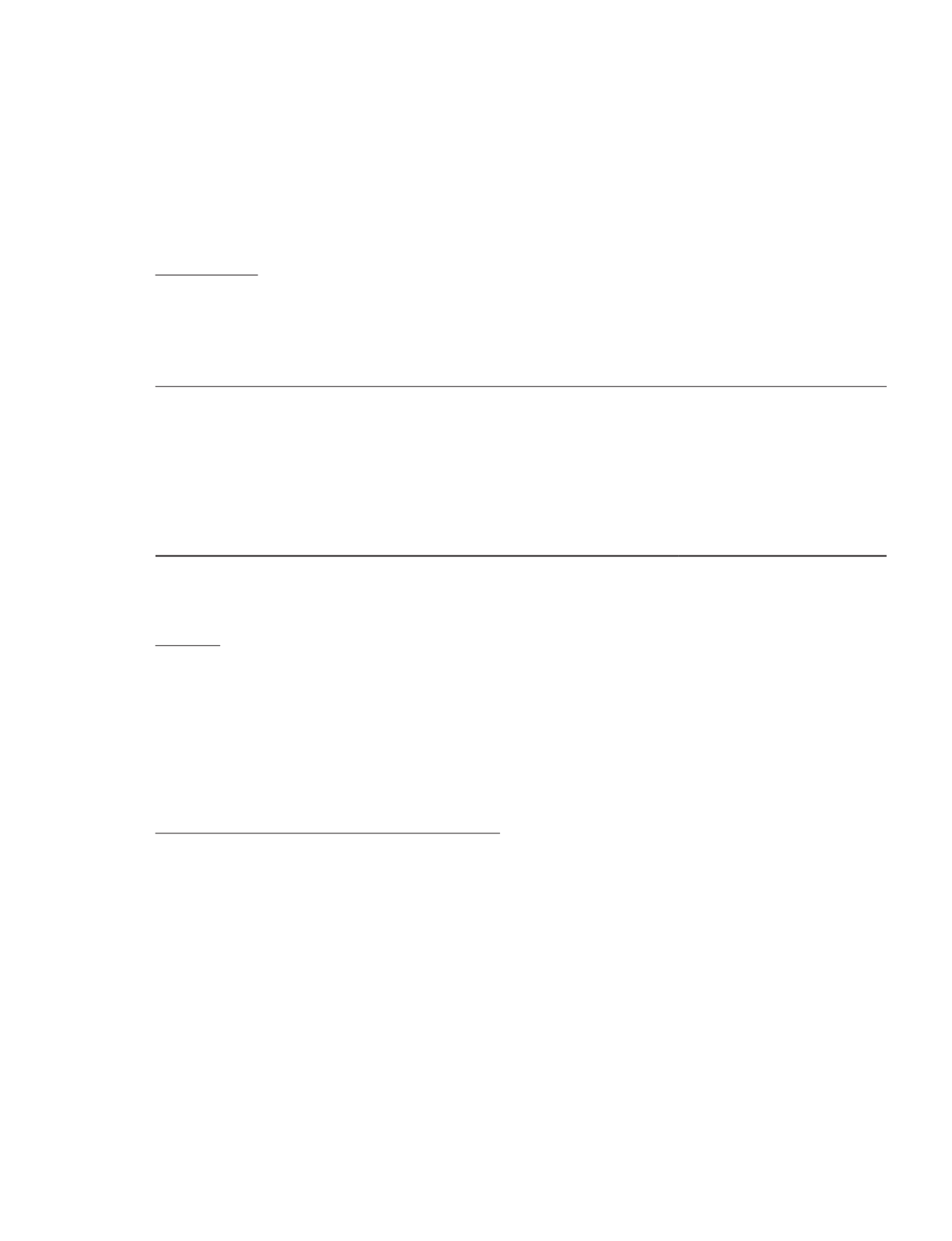

Group

Increase/

decrease

in basis point

Effect on

profit

after tax

$’000

31 December 2014

– Singapore Dollar

+25

505

–25

(505)

– Malaysian Ringgit

+25

(165)

–25

165

– Japanese Yen

+25

(20)

-25

20

At the end of the reporting period, for the increase/decrease in the various basis points on interest rates for the

various currencies, the effects associated with such changes on the Group’s profit after tax are as illustrated above.

(c)

Credit risk

Credit risk is the risk of loss that may arise on outstanding financial instruments should a counterparty default on

its obligation. The credit risk arising from the Group’s normal commercial operations is controlled by individual

operating units within strict credit control and guidelines. Policies are in place to ensure on-going credit evaluation

and active account monitoring.

At the end of the reporting period, the Group’s and the Company’s maximum exposure to credit risk is represented

by the carrying amount of each class of financial assets recognised on the balance sheet.

Financial assets that are neither past due nor impaired

Trade and other receivables that are neither past due nor impaired are creditworthy debtors with good payment

record with the Group. Cash and cash equivalents, investment/marketable securities and derivatives that are neither

past due nor impaired are placed with or entered into with reputable financial institutions or companies.