NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

133

ANNUAL REPORT 2015

40.

FINANCIAL RISK MANAGEMENT (CONT’D)

(c)

Credit risk (cont’d)

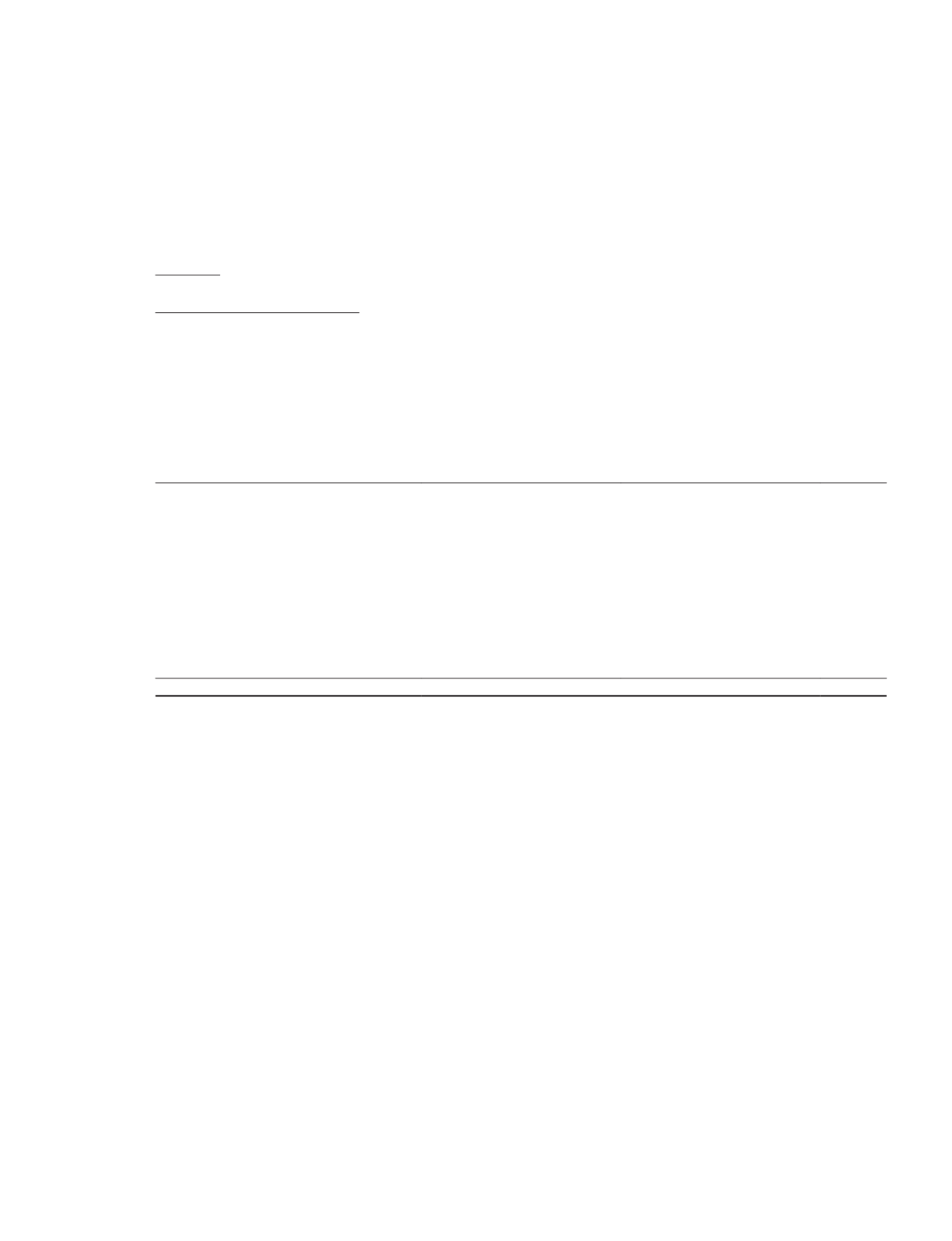

Credit risk concentration profile

The Group determines concentrations of credit risk by monitoring the country profile of its trade and other

receivables on an on-going basis. The credit risk concentration profile of the Group’s trade and other receivables at

the end of the reporting period is as follows:

Group

Company

2015

2014

2015

2014

$’000

% of

total

$’000

% of

total

$’000

% of

total

$’000

% of

total

By country:

Singapore

69,672

54

74,704

64

842,516

97

553,624

99

Malaysia

6,867

5

7,044

6

23,747

3

4,455

1

Indonesia

16,351

13

1,505

1

–

–

–

–

Australia

13,089

10

3,318

3

–

–

–

–

China, including Hong Kong

and Taiwan

1,790

1

4,203

4

–

–

–

–

South Africa

8,685

7

5,763

5

–

–

–

–

Germany

2,350

2

3,079

3

–

–

–

–

Other countries

9,348

8

16,474

14

–

–

–

–

128,152

100

116,090 100

866,263

100

558,079

100

Approximately 52% (2014: 57%) of the Group’s trade and other receivables were due from an associate located

in Singapore.