NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

138

THE STRAITS TRADING COMPANY LIMITED

41.

DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING ACTIVITIES

(a)

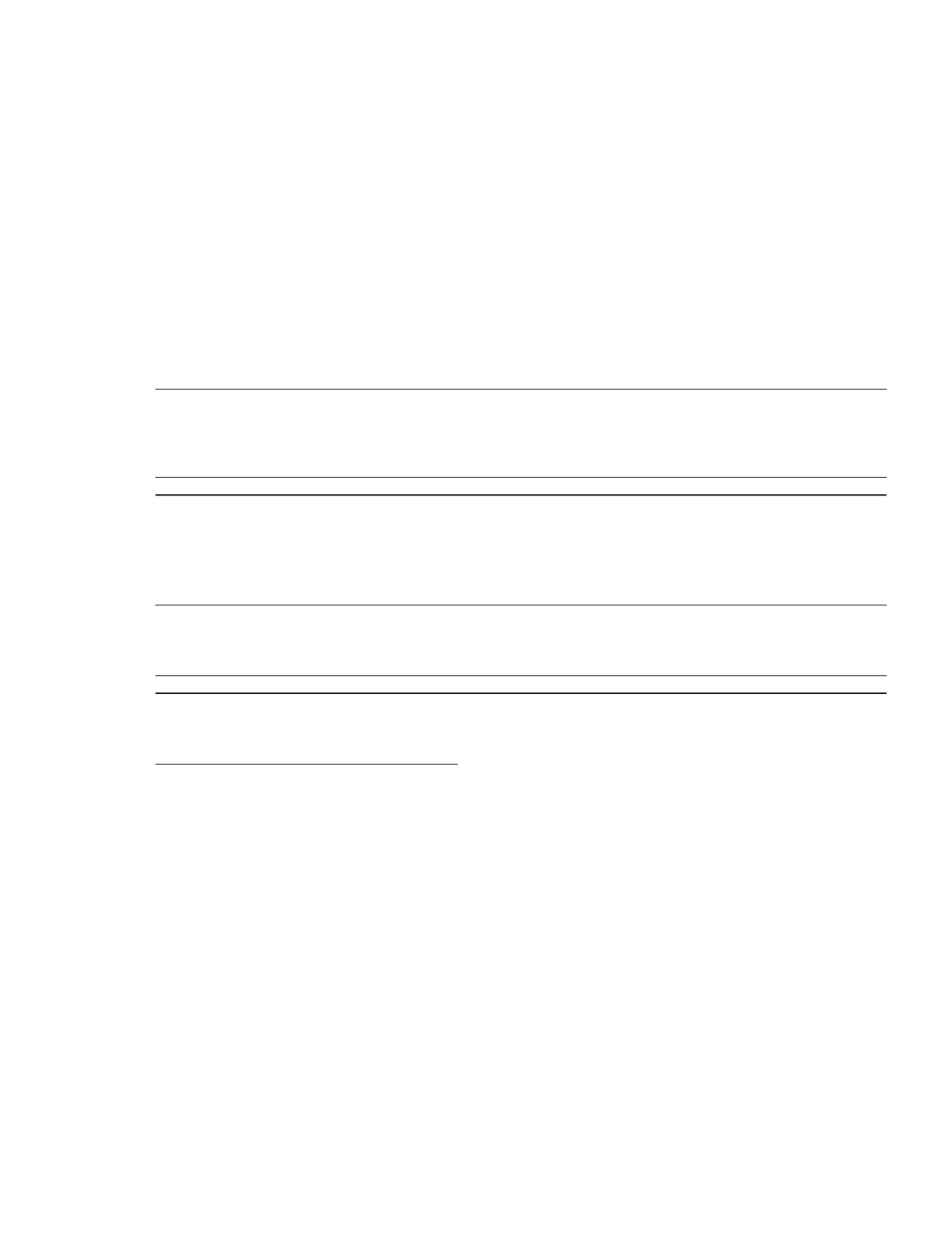

The Group has the following derivative financial instruments at balance sheet date:

At 31 December 2015:

Notional Amount

Fair Value

Asset

Liability

Asset

Liability

$’000

$’000

$’000

$’000

Forward currency contracts

648

49,965

1

1,807

Forward commodity contracts

–

3,249

–

1,514

Contract for differences

9,258

8,993

199

413

Interest rate swap contracts

– 100,327

–

24

9,906 162,534

200

3,758

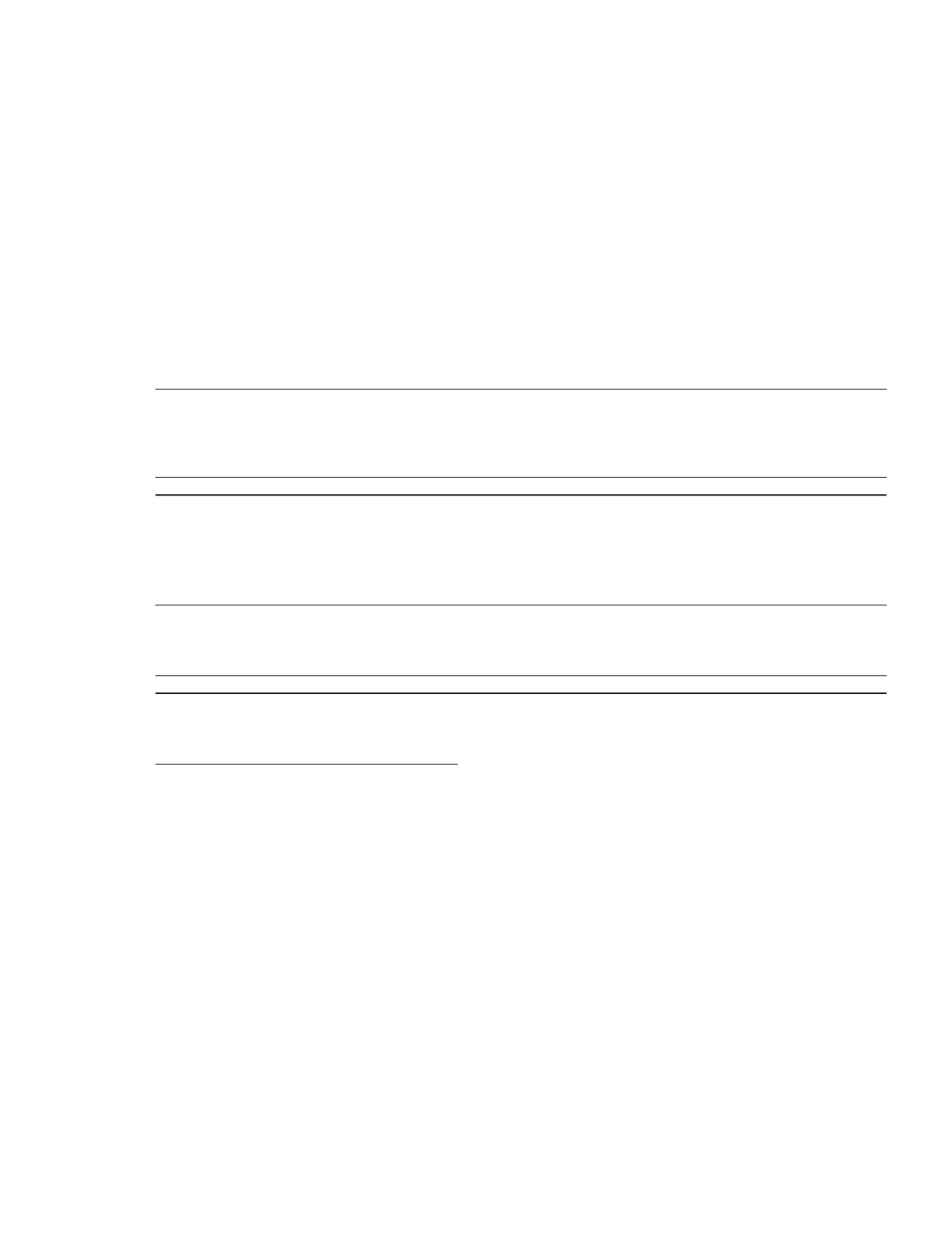

At 31 December 2014:

Notional Amount

Fair Value

Asset

Liability

Asset

Liability

$’000

$’000

$’000

$’000

Forward currency contracts

– 72,395

–

2,142

Forward commodity contracts

–

2,118

–

160

Interest rate swap contracts

–

9,926

–

21

– 84,439

–

2,323

Please refer to note 23 for detailed information relating to the risk being hedged.

(b)

Hedge of net investments in foreign operations

Included in borrowings (note 32) at 31 December 2015 was a loan of Japanese Yen1.23 billion which has been

designated as a hedge against the net investment denominated in Japanese Yen. It is being used to hedge the Group’s

exposure to foreign currency risk on this investment. Gain or loss on the retranslation of the borrowing is taken to

the exchange translation reserve to offset any exchange differences on the translation of the net foreign investment.