OVERVIEW

SRE Capital is a Singapore-based asset management company

that specialises in investing in public-listed real estate and

infrastructure related securities within the Asia Pacific region.

SRE Capital was incorporated in October 2014 and received its

Capital Market Services Licence from the Monetary Authority

of Singapore in March 2015. With more than 34 years of

experience in securities trading and fund management,

Mr Stephen Finch leads the team at SRE Capital. He is

supported by a team of professionals with experience in

real estate securities investing throughout the Asia Pacific.

Augmented by the expertise and network of SRE Capital’s

shareholders and Board of Directors, the team has access to

unique insights into the real estate investment landscape.

S

RE Capital launched its first fund, the SRE Asian Asset Income

Fund (“SAAIF”), in April 2015. SAAIF is a dividend paying income

fund that invests in a diversified portfolio of real estate-related

equities listed across Asia Pacific. The fund predominantly

invests in real estate investment trusts (“REITs”). SAAIF aims to

deliver higher income and lower volatility than can be achieved

by investing directly in REITs, and affords moderate capital

growth over the long-term that is consistent with the price

appreciation of core commercial real estate in Asia Pacific.

The team relies on macroeconomic analysis as well as in-depth

fundamental research when investing. The team’s research

capabilities and insights from strategic partners enable SRE

Capital to tap into high quality cash flows from a diversified

pool of core commercial real estate through publicly listed

securities in Singapore and around the Asia Pacific region. SRE

Capital’s unique strategy coupled with its hedging techniques

ensures higher levels of cash distribution, while lowering equity

market volatility versus investing directly in REITs.

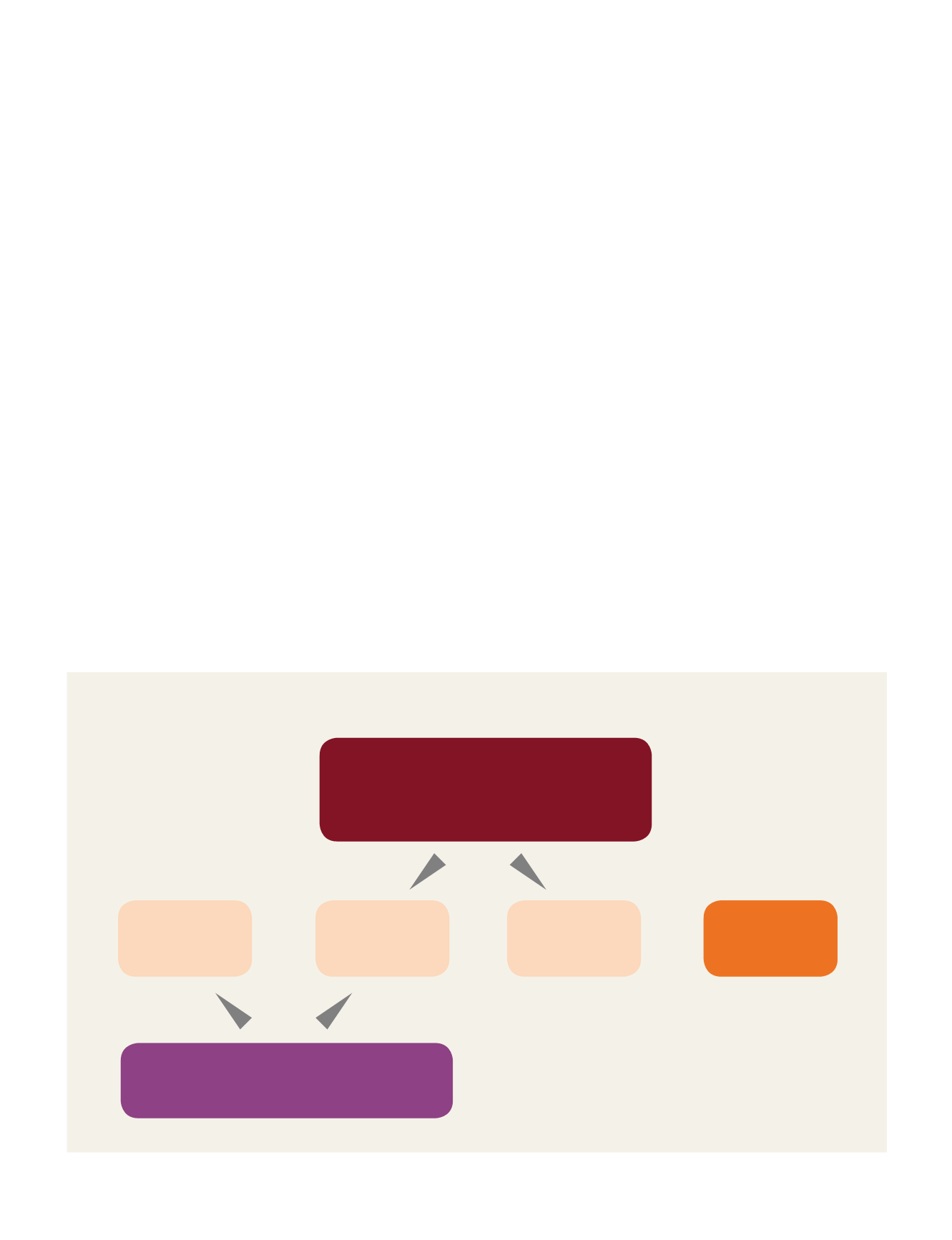

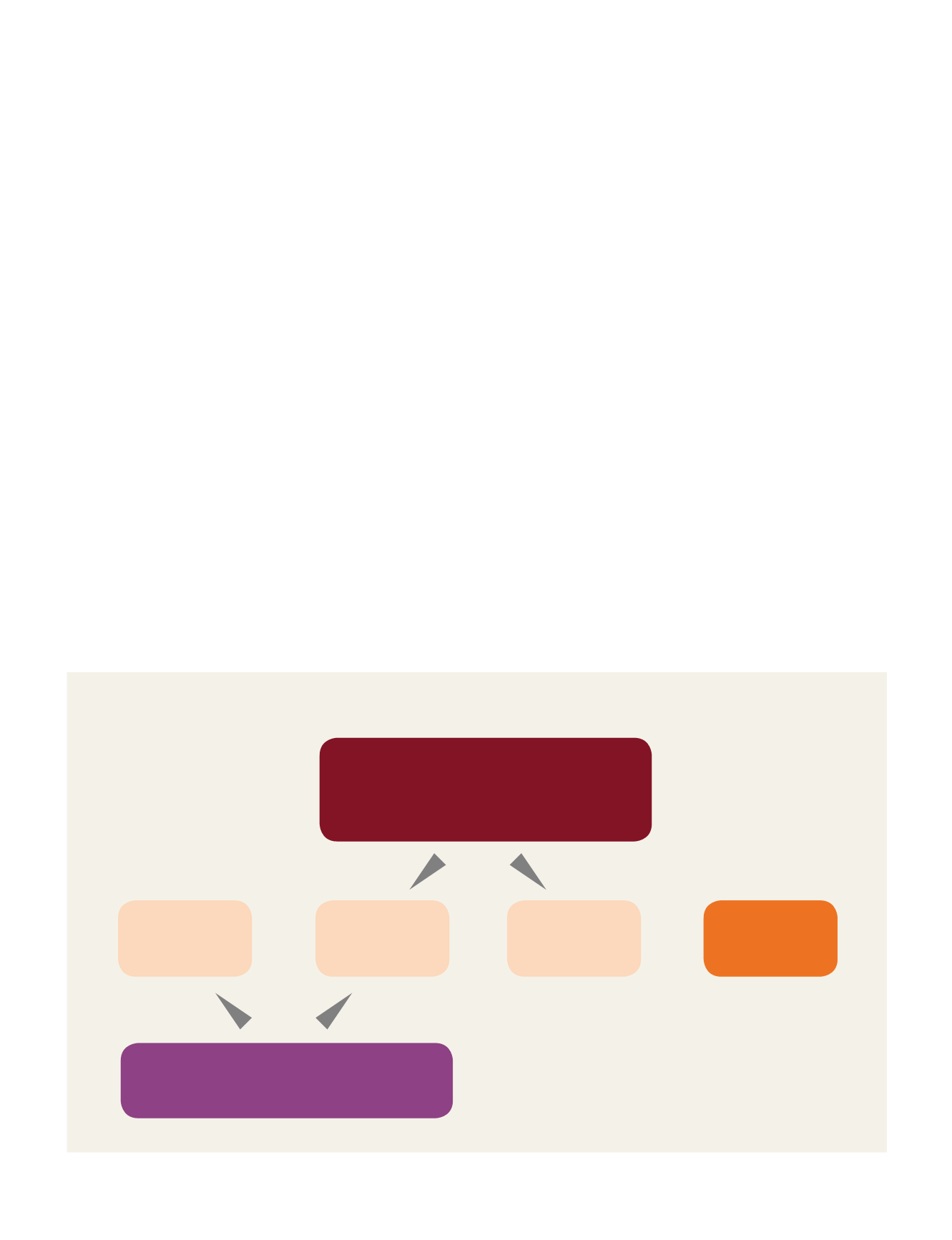

INVESTMENT STRATEGY

In the year ahead, SRE Capital will continue to rely on its

capabilities and unique strategy to drive investment returns

while minimising volatility inherent in listed real estate securities.

Top Down Micro View

Macroeconomic Outlook

Capital Markets

Foreign Exchange

Liquidity

Bottom Up Stock Selection

Quantitive and Qualitative Screening

In-Depth Fundamental Research

Insights from Strategic Partners

Hedging

Techniques

SRE Capital’s

Investments

Listed

Real Estate

Portfolio

Unique

Strategy

+

+

=

SRE CAPITAL INVESTMENT MODEL

SRE CAPITAL PTE. LTD.

(“SRE CAPITAL”)

25

ANNUAL REPORT 2015