ARA ASSET MANAGEMENT LIMITED (“ARA”)

ARA Asset Management Limited, a 20.1%-owned associate of

Straits Trading, is one of the largest real estate fund managers in

the region. ARA manages listed REITs in Singapore, Hong Kong

and Malaysia and also invests in and manages private real estate

funds in the Asia Pacific region. Its real estate portfolio spans

the office, retail, logistics, hospitality and residential sectors.

ARA also offers real estate management advisory services,

which complement its fund management business.

In 2015, ARA’s total assets under management (“AUM”) grew 11.9%

from S$26.7 billion to S$29.8 billion (as at December 2015). As

a result, the recurrent management fees to ARA increased from

S$125.5 million to S$129.6 million for FY2015 and its adjusted net

profit

1

grew 16% year-on-year to S$72.1 million.

In September 2015, ARA successfully raised US$325 million in

capital commitments for Peninsula Investment Partners, a new

private fund platform with the mandate to invest in real estate

assets across Asia, including Australia, Singapore, Hong Kong,

China and Japan. In the same month, the California Public

Employees’ Retirement System (“CalPERS”) added US$300

million to ARA’s China platform, China Investment Partners.

In October 2015, ARA successfully launched a new privately-

held REIT, ARA ShinYoung Residential Development Real Estate

Investment Company, which has the mandate to invest in

residential assets in South Korea.

In December 2015, ARA established the ARA Harmony Fund V

(“Harmony V”), a private real estate fund for the redevelopment

of Park Mall, a commercial and retail property located within

Singapore’s prime shopping belt, Orchard Road. The investors

of Harmony V include the SingHaiyi Group of companies, Haiyi

Holdings Pte Ltd and Suntec Real Estate Investment Trust.

As the largest shareholder of ARA with a 20.1% stake, Straits

Trading will continue to support ARA in delivering its strategies

to grow its REIT platforms through yield-accretive acquisitions

while seeking opportunities in private funds to venture into

new markets and jurisdictions. In December 2015, ARA raised a

total of S$152.1 million via a rights issue, which Straits Trading

subscribed to its full entitlement. The capital raised will provide

ARA with greater financial capacity and flexibility to meet its

funding needs to support its growth as well as to capitalise on

growth opportunities as and when they arise.

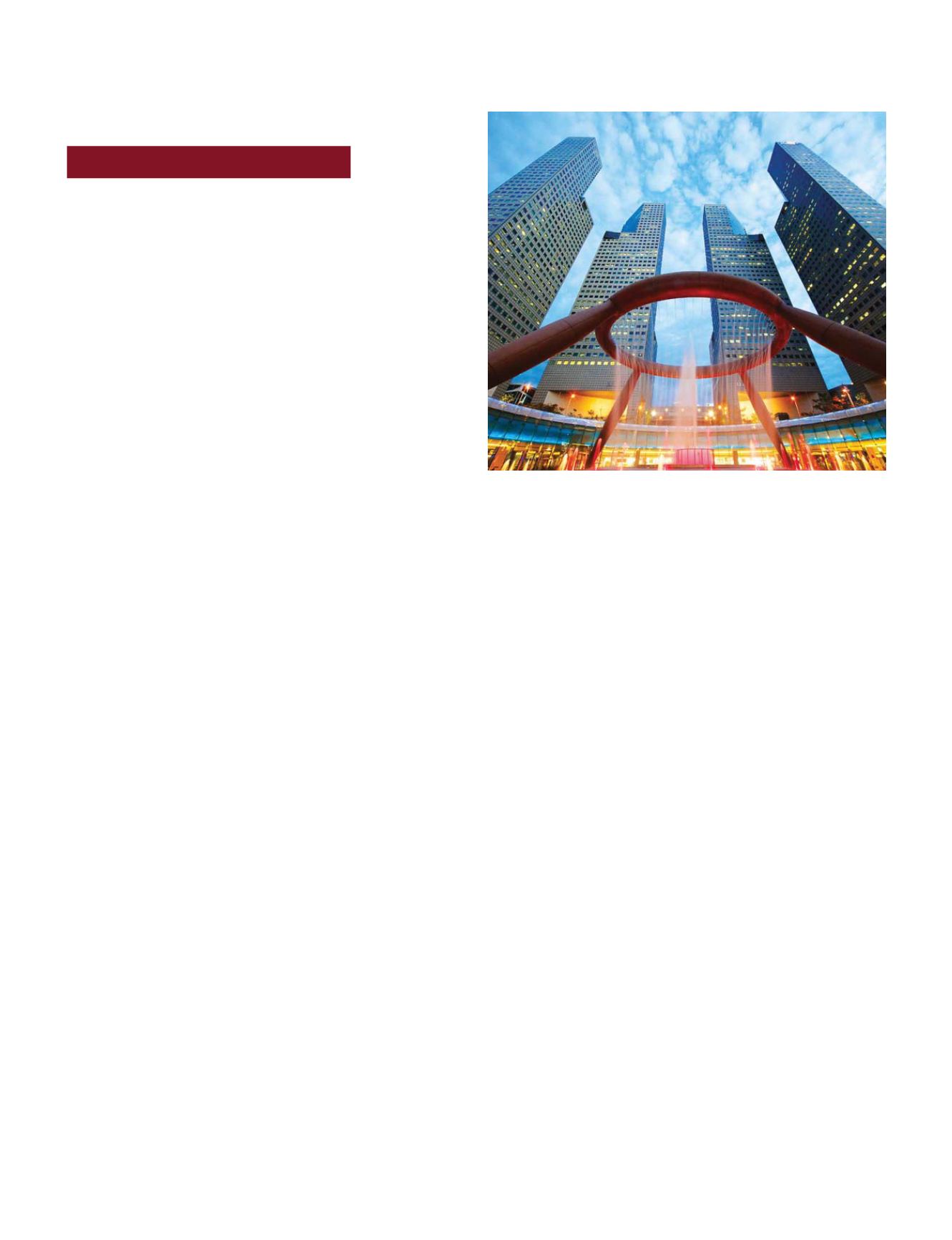

SUNTEC REAL ESTATE INVESTMENT TRUST

(“SUNTEC REIT”)

As at Jan 2016, Straits Trading had an aggregate shareholding

(including its deemed interest in shares of Suntec REIT held by

ARA) of 8.21% in Suntec REIT.

For FY2015, Suntec REIT reported gross revenue of S$329.5

million and net property income of S$229.2 million that were

16.7% and 19.6% higher year-on-year respectively due to

the opening of Phases 2 & 3 of Suntec City mall and higher

contribution from Suntec Singapore.

In November 2015, Suntec REIT acquired three floors of strata

office space in Suntec City of approximately 38,000 sq. ft. It

also completed the divestment of Park Mall in December 2015

and entered into a joint venture to redevelop the property to

further unlock underlying value.

STRAITS INVESTMENT PARTNERS (“SIP”)

Straits Investment Partners is a managed account under ARA that

oversees Straits Trading’s investment property portfolio. In April

2015, Atbara Holdings Private Limited (“Atbara”) was divested

to Haiyi Holdings, for S$53.8 million. Atbara owned 14 units in

The Holland Collection, a freehold residential development on

Holland Road.

The remaining investment properties in Singapore include

condominium units at Gallop Green and Good Class Bungalows

(“GCBs”) at Cable Road and Nathan Road. In Malaysia, the

portfolio comprises Wisma Straits Trading Building, and includes

land, buildings and shophouses in Butterworth, Penang.

SIP will continue to look to maximise the yield on its remaining

real estate portfolio while concurrently looking for attractive

opportunities for asset divestment.

Suntec City, Singapore

1

Adjusted for (i) gain / (loss) on fair valuation / disposal of financial assets; (ii) acquisition, divestment and performance fees; (iii) bargain purchase arising from acquisition;

(iv) impairment on available for sale financial assets; (v) gain / (loss) on disposal of investments and (vi) performance-based bonuses

YEAR IN REVIEW

REAL ESTATE

26

THE STRAITS TRADING COMPANY LIMITED