Rahman Hydraulic Tin (“RHT”)

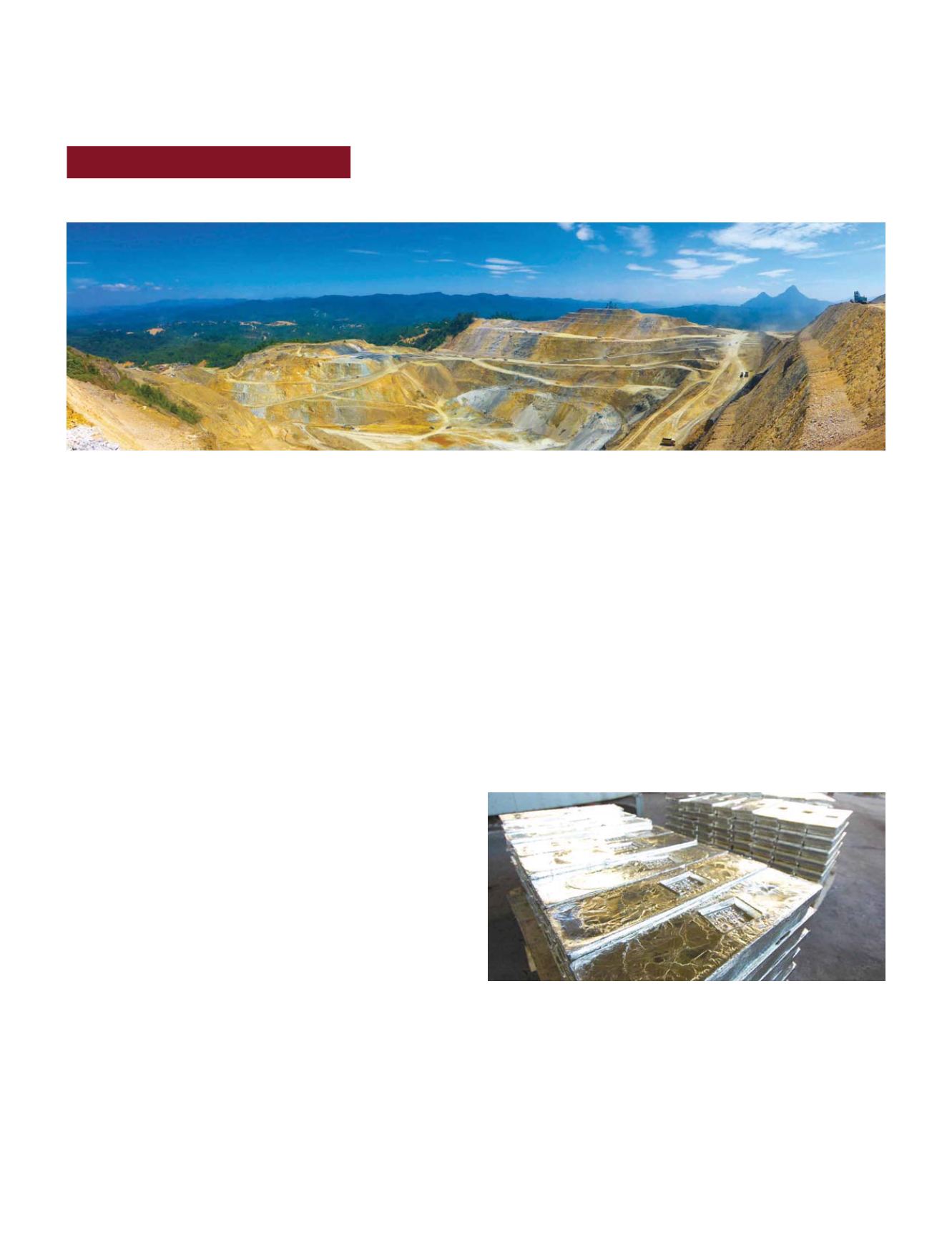

RHT, which operates a hard-rock open-pit tin mine in the

State of Perak, maintained its position as the largest producer

of tin-in-concentrate in Malaysia, accounting for about 57%

of the country’s tin production in 2015.

All processing plants at the mine operated at full capacity

throughout the year, treating ore material mined from the

open-pit operation. The 2015 production volume of 2,196

tonnes of tin-in-concentrates was similar to that in 2014.

Profit before tax, at RM14.19 million, was 52% lower than

that recorded in 2014, mainly attributable to a 12% drop in

net realisable tin price compared to 2014. The second half

of 2015 was particularly challenging as tin prices plummeted

further but RHT was able to remain profitable as USD receipts

were converted to higher Malaysian Ringgit, and cost-cutting

measures were implemented.

OUTLOOK

The world economy and resource markets are expected to

continue to be challenging. While global commodity cycles are

unpredictable, the underlying operations of MSC are expected

to perform satisfactorily in 2016. MSC will continue to stay

focused on its cost rationalisation and optimisation efforts for its

core operating divisions to ensure that it remains profitable and

sustainable through the current challenging market environment.

Rahman Hydraulic open pit tin mine

Newly smelted tin ingots ready for delivery

Straits Trading’s 54.8%-owned resources subsidiary, Malaysia

Smelting Corporation Berhad (“MSC”) is the world’s second

largest supplier of refined tin.

Against the backdrop of a very volatile industry environment

marked by a severe and unprecedented down-cycle in the

global resource and commodity sectors, 2015 proved to be a

challenging year for MSC.

FINANCIAL PERFORMANCE

Depressed tin prices, coupled with volatile local currency

movements in 2015, materially impacted MSC’s financial results.

MSC registered a lower annual profit before tax of RM3.24 million

for the year ended 31 December 2015 (“FY2015”), compared with

a year ago. Its pre-tax results were impacted by an unfavourable

stock valuation adjustment arising from a lower tin price as at

end December 2015 and a net foreign exchange loss. After

deducting income tax expenses, MSC reported a net loss of

RM4.8 million in FY2015. FY2015 revenue was 23.5% lower at

RM1.46 billion from RM1.92 billion in 2014, primarily due to

lower sales quantity of refined tin and lower tin prices.

CORE OPERATIONS

MSC’s core operations comprising the international tin smelting

business at Butterworth and tin mining operation at Northern

Perak still managed to achieve a satisfactory performance despite

the difficult environment.

International Smelting Business

The Butterworth international smelting operations recorded

a pre-tax loss of RM 5.48 million in FY2015. The Butterworth

Smelter was smelting close to full capacity and earnings were in

line with expectations, but the bottom line was impacted by the

unfavourable stock valuation adjustment and foreign exchange loss.

Tin metal production decreased to 30,209 tonnes in 2015 from

34,971 tonnes in 2014 due to lower feed intake numbers. Tin

concentrate intake for smelting was slightly lower, but the

intake of crude tin for refining fell significantly.

YEAR IN REVIEW

RESOURCES

29

ANNUAL REPORT 2015